Navigating a tax audit can seem intimidating, but it doesn’t have to be a stressful ordeal. With the right knowledge and preparation, anyone can handle this process smoothly.

Being selected for an audit doesn’t automatically suggest any wrongdoing; it’s a routine procedure to verify the accuracy of tax filings. The experienced tax audit attorneys at Gordon Law have defended hundreds of IRS and Illinois tax audits, helping clients save millions of dollars in taxes and penalties. We’re here to help you understand the audit process and provide essential tips.

Here, we’ll outline a clear roadmap to confidently approach an audit, ensuring you’re well-prepared and informed. Let’s get started on how to effectively tackle an audit.

1. Review Your Audit Notice

When you receive a notification of a tax audit, it’s natural to feel a bit overwhelmed—but with a little preparation, you can start building an effective defense.

Start by thoroughly reviewing the notification from the IRS or state tax authority. This letter is your guide to understanding why you’re being audited and what the next steps are.

- Check the Basics: First, check the basics. Is the notice addressed to the correct person? (Hey, mistakes happen!) Is the notice coming from the IRS or a state tax board? And if you’re a business owner, does the audit pertain to your business tax returns or personal tax returns?

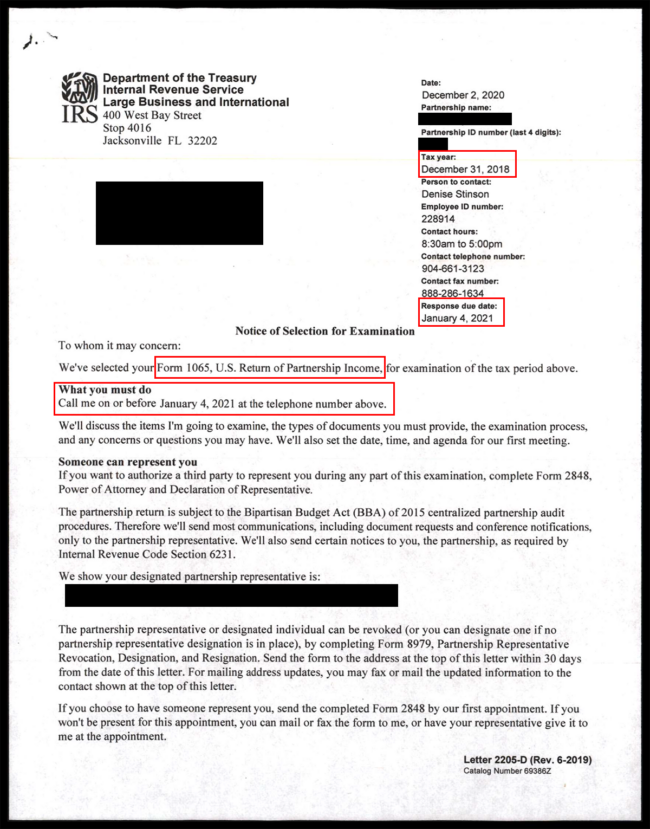

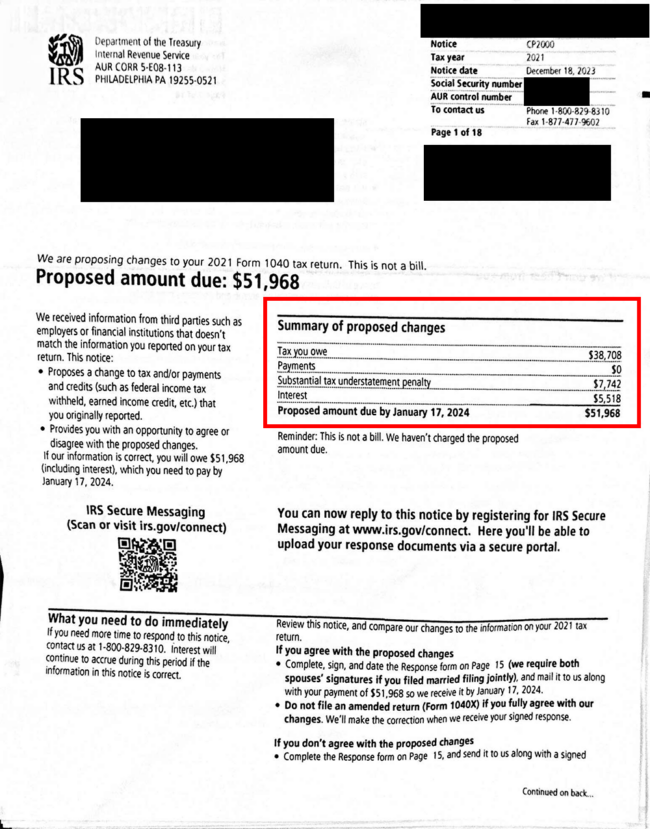

- Determine the Tax Year(s) Under Review: Find out which years’ returns are being audited. This should be prominently stated in either the top right corner of the notice or near the center of the first page. Audits usually cover returns filed in the last 3 years, but the IRS may look further back if they find significant discrepancies.

- Identify the Specific Areas Being Audited: The audit notice will often specify which parts of your tax return are under scrutiny. This could range from specific income sources to deductions and credits you’ve claimed. Knowing these details is essential for preparing your audit defense.

- Look for Next Steps on Your Audit Notice: Your notice will include a deadline for your response and what you need to do next. The IRS may ask you to submit certain documents by the deadline or book an initial meeting. You can hire a professional to respond on your behalf and represent you during the audit.

Understanding the scope of the audit is a vital first step in the process. It sets the stage for effectively organizing your documentation and preparing your response, ensuring you’re in a strong position to address the audit’s concerns.

There are many different types of notices the IRS may send to initiate an audit. They may look a little different, but they’ll always arrive by certified mail and contain the IRS logo, your taxpayer information, the examiner’s contact information, and more.

Example of an IRS Audit Notice: Partnership Audit

Example of an IRS Audit Notice: CP2000

CP2000 letters are increasingly common for cryptocurrency audits. Learn more about IRS Notice CP2000 here.

2. Consult a Professional to Understand Your Options

Play it safe and consult a tax professional, ideally before you respond to the IRS notice. Our tax audit lawyers have guided taxpayers through hundreds of IRS and Illinois tax audits, and we’ve found that most people aren’t aware of the options available to improve the outcome of an audit.

Most tax attorneys offer a free initial consultation. Even if you decide to face the IRS on your own, it’s wise to arm yourself with some insider knowledge first.

Benefits of hiring professional audit representation include:

- Pay Less Tax: You can often save money by hiring an IRS audit attorney. Our attorneys can negotiate with the IRS; defend specific items on your return; keep the audit from escalating or expanding; and attempt to reduce penalties, which often make up a large portion of the bill.

- Focused Knowledge: If your audit touches on complicated items like cryptocurrency, offshore accounts, multiple business entities, or sales and use tax, it’s wise to hire a professional with experience in those specific areas. Not all tax professionals (or even all IRS examiners) have a strong understanding of the tax law for these complex areas.

- Save Time: Many of our clients just want to get their audit over with as quickly and painlessly as possible. Hiring a professional who knows exactly what to do can really streamline the process by eliminating needless back-and-forth.

- Minimize Stress: With a skilled tax attorney on your side, you can rest assured that every detail will be taken care of. Plus, in most cases, our clients don’t have to speak to the IRS examiner at all!

Have questions about your IRS audit? Reach out for a free consultation.

3. Make a Game Plan

Once you know what to expect from your IRS audit, the next step is to create a comprehensive plan of action. It’s crucial to go into an audit with organized documents, as well as a prepared strategy for any known items of concern.

For example, if you traded cryptocurrency, you need to provide detailed information about every single taxable transaction, including crypto-to-crypto swaps. Automated software often calculates your crypto taxes wrong—and that includes the software used by IRS auditors. By preparing a complete and accurate crypto tax report beforehand, you can defend your position and avoid getting slapped with an unfairly high tax bill.

At Gordon Law, we’ll pinpoint any red flags before the audit even begins. This way, we can defend specific items on your tax return; prevent the scope from increasing; and help to minimize what you owe. With years of experience defending IRS audits, we know how the IRS operates and which levers to pull to help secure a favorable result.

4. Answer IRS Questions on Time—and Keep It Simple

Navigating an IRS audit requires a careful balance between thoroughness and simplicity, especially when responding to their inquiries. Timeliness and clarity in your communication are key to a smooth IRS audit. However, you should avoid giving any more information than is necessary.

- Focus on directly addressing the IRS’s queries with clear, concise information.

- If the IRS requests specific documentation, provide exactly what is asked for and nothing more.

- It’s natural to be nervous, but avoid saying anything more than you absolutely must. You might think you’re providing a reasonable explanation for a tax mistake, but this could cause the IRS to expand the audit scope; assess additional penalties; or even open up a criminal tax investigation.

This approach underscores the importance of having your records well-organized before the audit begins. If you can quickly supply the requested information, not only will this demonstrate your compliance, but it also helps to maintain the focus of the audit on the original points of interest.

Throughout this process, maintaining a professional demeanor and a cooperative attitude towards the IRS representatives can also play a crucial role in the audit’s progression.

In essence, your goal during an IRS audit is to provide the requested information in a manner that is both efficient and effective, minimizing the potential for the audit to delve into areas beyond its original scope. By answering questions on time and keeping your responses straightforward, you contribute to a more straightforward and manageable audit process.

At Gordon Law, we can handle the entire process for you and maximize your chances of a favorable audit result. Reach out today and consult with an experienced tax attorney for free.

5. Disagree with the Results? Request an Appeal

If you find yourself at odds with the IRS audit results, it’s important to know that you have the right to appeal the decision. The IRS provides a formal appeals process for taxpayers who believe their audit results are incorrect or unjust.

Initiating an appeal involves submitting a written protest in which you outline your disagreements with the audit findings and provide supporting documentation or legal arguments to back your position.

The audit appeal process is your opportunity to have your case reviewed by a different set of eyes within the IRS—one that’s independent of the original auditing team. This can be particularly helpful if you have new evidence that wasn’t considered during the initial audit or if you believe the law has been misapplied in your case.

Need Help with Your IRS Audit? Call Gordon Law

If you’ve been selected for an IRS audit and you’re feeling lost, reach out to Gordon Law for a free consultation. With years of experience defending audits, we take the stress off your shoulders and make the audit process as smooth and simple as possible.

Reaching out today could save you thousands, or even millions, of dollars on your tax audit! Let’s get to work preparing a strong audit defense.