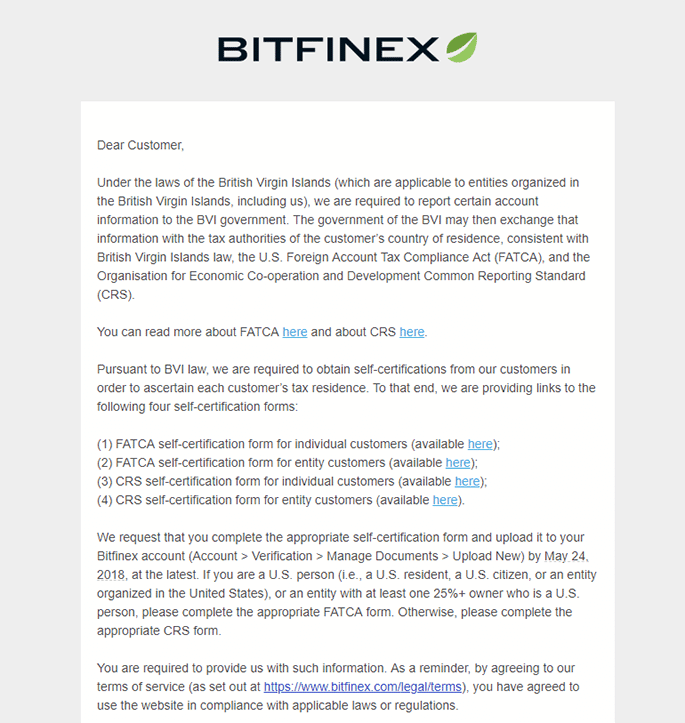

On May 14, 2018, the cryptocurrency trading platform Bitfinex declared that users must disclose certain information for tax reporting purposes. The exchange, which is based in the British Virgin Islands (“BVI”), announced that jurisdictional regulations require it to hand over certain financial information to the BVI government. In turn, BVI officials “may” exchange that information with international tax authorities, including the IRS on account of the Foreign Account Tax Compliance Act (“FATCA”).

What is FACTA and Why Should Crypto Investors Care About It?

Enacted in 2014, FATCA requires foreign financial institutions to disclose U.S. account holder information to the U.S. government. Most countries, like BVI, have signed information sharing agreements and consented to provide certain financial data to the US Department of Treasury and Internal Revenue Service.

Under FATCA, signatory countries incur penalties for noncompliance — so, they’re all adhering to the agreement.

Bitfinex Requiring Self-Certification

It’s reasonable to assume that Bitfinex will provide taxpayer information to the BVI government. The BVI government will also likely comply with FATCA and hand over information to U.S. authorities.

Moreover, Bitfinex is requiring individuals and businesses to self-certify their tax reporting requirements. What happens if you don’t fill out the forms? Bitfinex hasn’t said, but most banks take steps to close accounts when these forms are neglected.

And Don’t Forget About FBAR

One of the thorniest requirements of FATCA is the Foreign Bank Account Report, FinCEN Form 114 — a.k.a. “FBAR” — which require taxpayers to disclose overseas financial holdings if their aggregate value is $10,000 or more. The FBAR form is a disclosure, meaning it’s not a tax assessment process. However, taxpayers with foreign holdings annually need to report their maximum account balances.

FBAR and Crypto Holdings: What Are You Required To Report?

Do FBARs apply to crypto exchanges? Many CPAs and tax attorneys believe that Uncle Sam requires token investors with holdings in foreign exchanges to disclose such on both FBARs and its sister requirement, Form 8938.

Though the IRS has yet to publish clear guidance on this issue, we can deduce from Bitfinex’s actions that crypto exchanges will likely adhere to requirements imposed on fiat foreign financial institutions.

What should taxpayers do Now?

First, assume that all foreign and domestic exchanges will disclose information to the U.S. government, if they haven’t already. It’s simply a matter of time and Bitfinex is the first crypto exchange to act.

Second, report all your taxable transactions on your tax return and also file FBAR and FATCA forms as required.

Contact a tax lawyer at the Gordon Law Group to discuss your filing options!