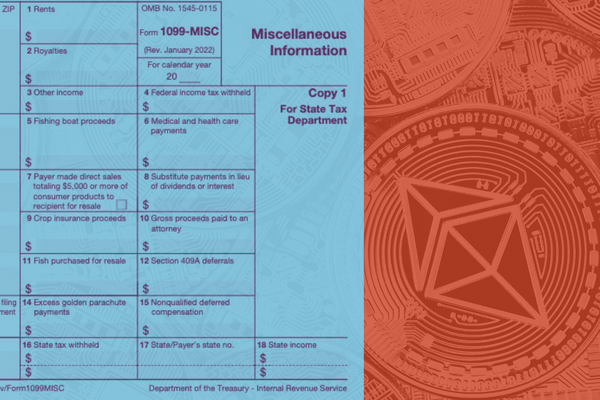

Form 1099-DA: What We Know So Far

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

The IRS has begun a new wave of audits targeting high-earning individuals and partnerships. Here’s how you can prepare.

Don’t miss your chance for significant tax savings—get ahead of the curve and master your crypto taxes before it’s too late. Here are 5 smart strategies you can use right now to lower that April tax bill.

Crypto tax loss harvesting is a way to avoid capital gains tax without damaging your portfolio. Learn how to use this powerful tax savings strategy!

Everything you need to know about crypto mining taxes! Learn how to report mining income, common mistakes to avoid, and tax saving tips.

Confused about crypto staking taxes? Our crypto accountants are here to help! Learn how to report staking rewards on your tax return.

Wondering how to calculate your crypto cost basis? It’s not as simple as you may think! Discover cost basis methods and common challenges for crypto investors.

The IRS is turning its sights on popular cryptocurrency exchange Kraken in its efforts to enforce tax compliance.

Wondering how crypto taxes work and how to report cryptocurrency on your taxes? Our experienced crypto accountants have your answers!

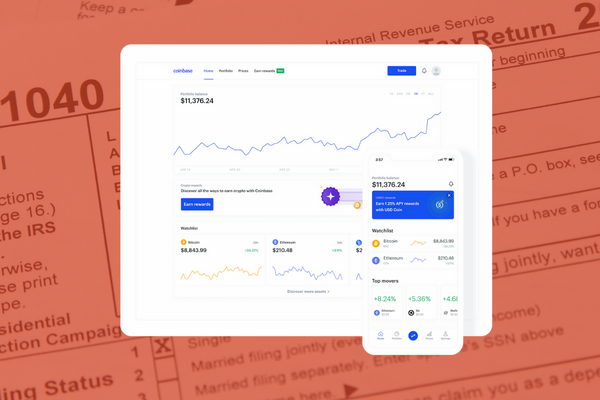

Discover how to report Coinbase taxes easily with this simple guide! Written by experienced crypto tax accountants.

Are you wondering how to avoid crypto taxes without breaking any rules? Discover 12 tried-and-true strategies from experienced crypto accountants!

Are you wondering how to report crypto losses on your taxes–or whether you need to report at all? Experienced crypto tax lawyers have your answers!

Wondering how to calculate crypto capital gains? It may be more difficult than you realize. This simple guide breaks it down step by step.

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279