Form 1099-DA: What We Know So Far

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

A question about digital assets, which has appeared on personal tax returns for several years, has been added to business tax returns as well.

Forming an LLC for cryptocurrency can enhance privacy and protect your assets. However, there are some misconceptions about the benefits of an LLC. Learn whether a crypto LLC could work for you!

The IRS has once again delayed the $600 threshold for Form 1099-K reporting. Our experienced tax attorneys explain what you need to know about this update and your filing requirements.

With 0% capital gains tax and 4% income tax, Puerto Rico can offer serious tax savings. Discover whether this is the right move for you.

Did you receive a CP2000 letter about cryptocurrency taxes? We can help!

New crypto accounting rules from the Financial Accounting Standards Board will provide more financial transparency for businesses with cryptocurrency on their balance sheets.

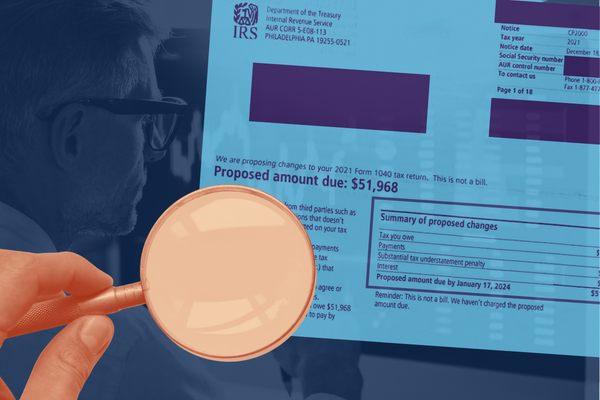

Are you a Robinhood or BlockFi user who’s received IRS letter CP2000? This is the start of a crypto tax audit. Here’s what you need to know.

2023 was a landmark year for cryptocurrency regulation, with several regulatory bodies vying for control over digital assets. What’s in store for 2024? The team at Gordon Law weighs in.

Good news for crypto businesses: A new requirement to file Form 8300 for cryptocurrency payments of $10,000 or more has been delayed pending further regulations.

Love them or hate them, NFTs are here to stay. Some only see a digital picture of an ape in human clothing. Others see an opportunity for creatives and artists to securely sell or trade with people all over the world via the blockchain. The NFT market has exploded over the last several years and shows no signs of letting up.

Do you have hidden tax savings languishing in your wallet? Here’s how to unlock them and lower your bill.

The IRS has begun a new wave of audits targeting high-earning individuals and partnerships. Here’s how you can prepare.

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279