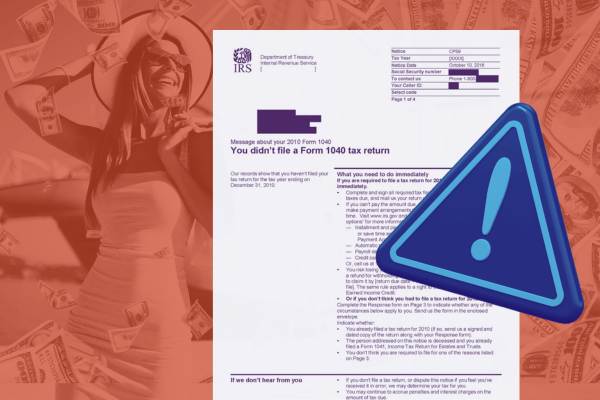

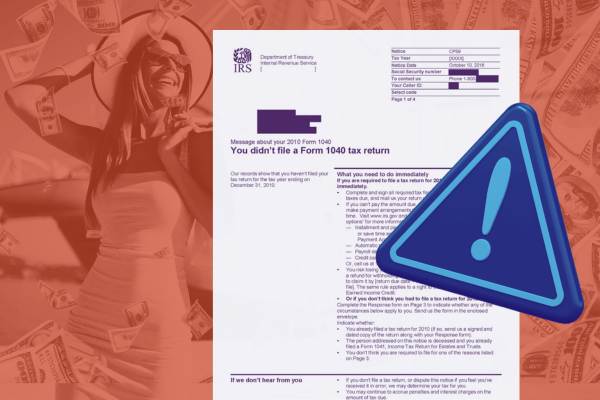

New IRS Initiative Targets High-Income Non-Filers

The IRS is targeting wealthy non-filers who haven’t filed tax returns between 2017 and 2021. Learn what you should do if you receive Notice CP59.

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

The IRS is targeting wealthy non-filers who haven’t filed tax returns between 2017 and 2021. Learn what you should do if you receive Notice CP59.

When auditors discover fraudulent tax deductions, they asses hefty fines — and in the most egregious cases pursue criminal charges.

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279