Do you need help with Coinbase tax reporting? Then you’ve come to the right place!

If you’ve ventured into the world of digital currencies via Coinbase and need help understanding your tax obligations, you’re not alone. As experienced cryptocurrency accountants, we’ve helped many investors report their Coinbase taxes easily and accurately.

In this guide, we break down your reporting requirements and how to report Coinbase on taxes. Let’s clear up the haze and make tax time a breeze!

Do I have to pay taxes on my Coinbase account?

Yes—crypto income, including transactions in your Coinbase account, is subject to U.S. taxes. Regardless of the platform you use, selling, trading, earning, or even spending cryptocurrency can have tax implications.

Does Coinbase report to the IRS?

Yes, Coinbase reports information to the IRS on Form 1099-MISC. If you receive this tax form from Coinbase, then the IRS receives it, as well. It’s important to report your Coinbase taxes accurately to help avoid tax audits and penalties.

How much do you have to make on Coinbase to pay taxes?

You must report all capital gains and ordinary income made from Coinbase; there is no minimum threshold. This is confusing to many Coinbase users because the exchange only sends tax forms for certain types of income over $600. However, this doesn’t change your obligation to report all taxable income.

Which Coinbase transactions are taxable?

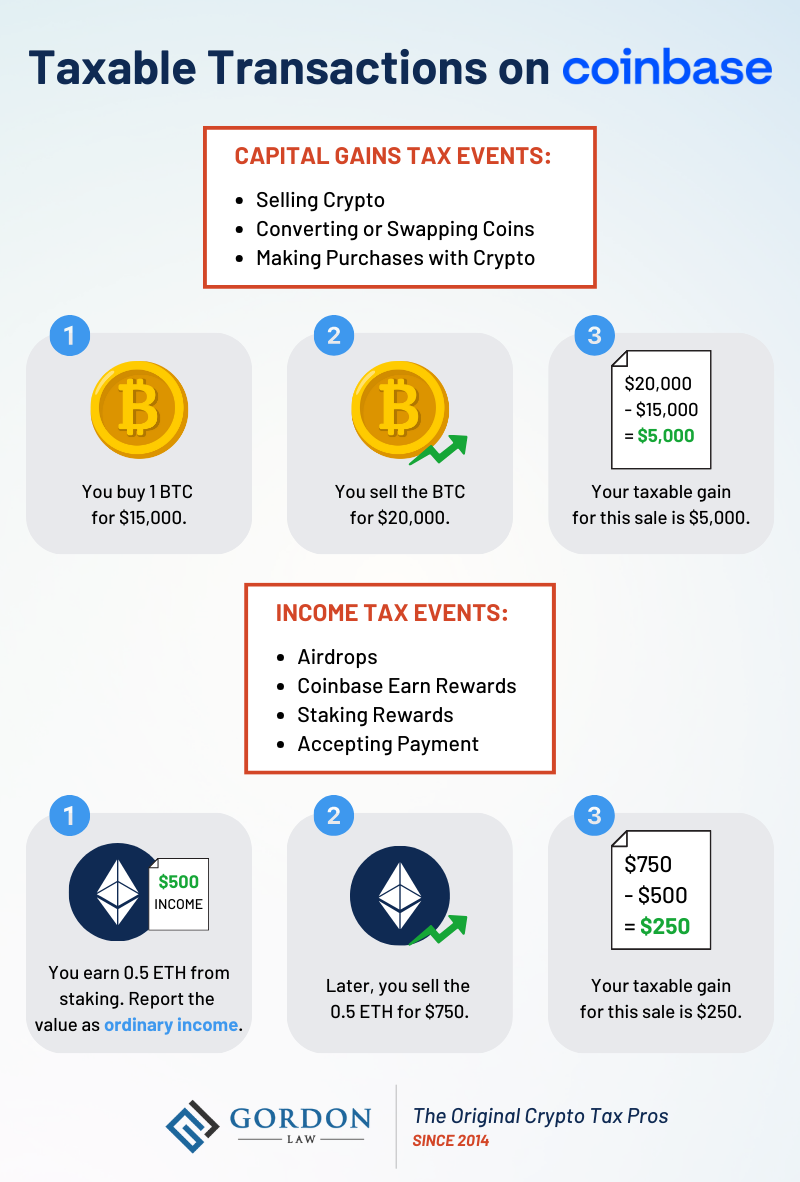

Taxable crypto transactions on Coinbase include:

- Selling cryptocurrency for fiat (e.g., USD, EUR, GBP)

- Converting one cryptocurrency to another

- Receiving cryptocurrency as a result of a fork or airdrop

- Earning rewards on your Coinbase account

- Using cryptocurrency for purchases, including purchases made with a Coinbase debit card

Some of these transactions trigger capital gains tax, while others trigger income taxes.

The following Coinbase transactions are not taxable:

- Buying and holding cryptocurrency

- Transferring crypto between Coinbase and other exchanges or wallets

Read our simple crypto tax guide to learn more about how crypto is taxed.

Coinbase tax documents

Some users receive Coinbase tax forms to assist in accurate reporting. Unfortunately, though, these forms typically lack essential information needed for filing Coinbase taxes.

Which tax form does Coinbase send?

Coinbase sends Form 1099-MISC to report certain types of ordinary income exceeding $600. This includes rewards or fees from:

- Coinbase Earn

- USDC Rewards

- Staking

Keep in mind that the Coinbase tax statement does not contain any information about capital gains. If you traded or swapped cryptocurrencies on Coinbase, then you’ll need additional information to file your crypto taxes.

Want to make your filing easy and accurate? Contact Gordon Law Group today!

What if I didn’t receive tax forms from Coinbase?

Not all Coinbase users will receive tax forms, even if they have taxable activity. If you didn’t receive Form 1099-MISC from Coinbase, then follow the steps below to file your Coinbase taxes.

How to report Coinbase on your taxes

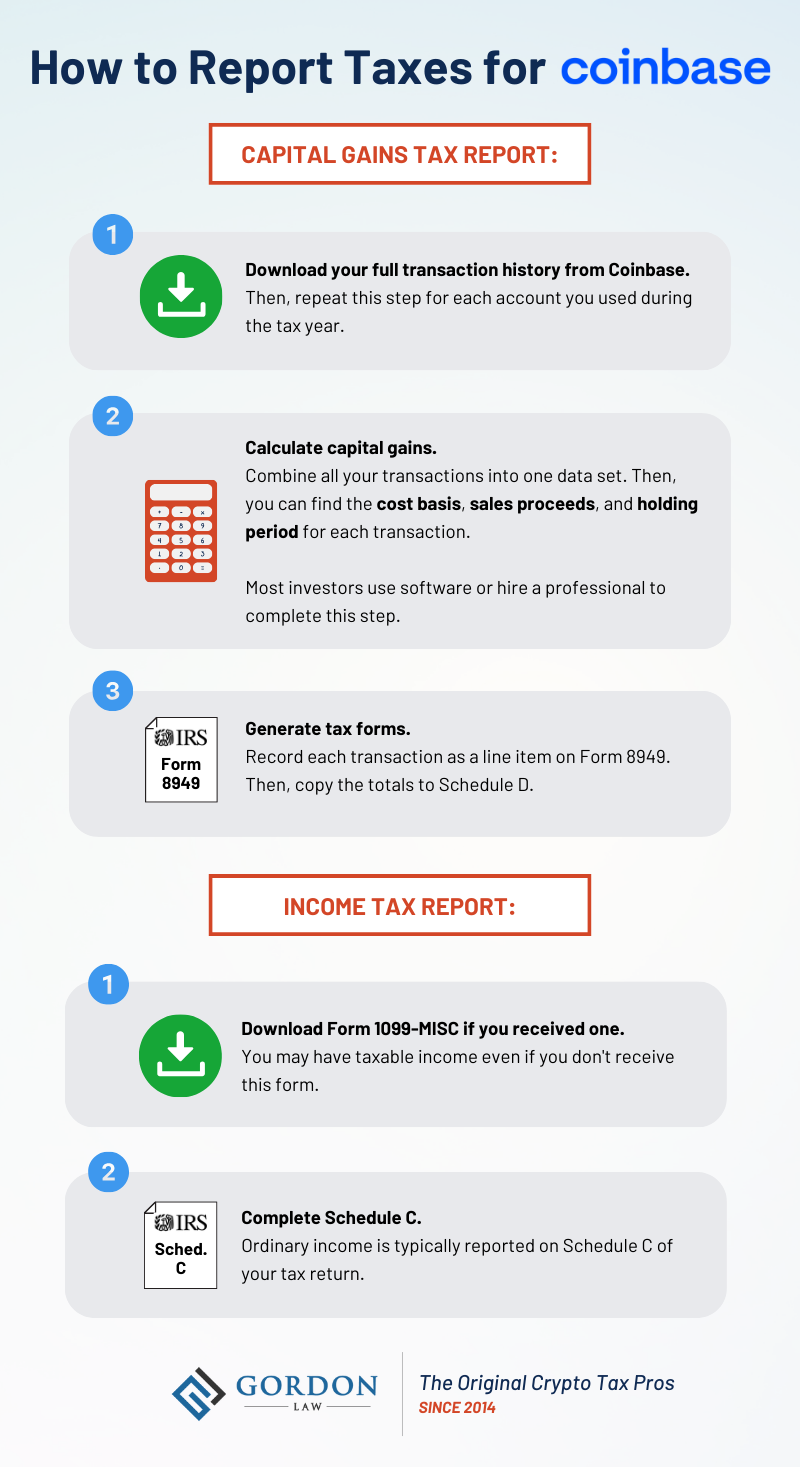

- Download Transaction History: Download your Coinbase transaction history as a CSV file from the Reports section of your account. You’ll also need to download a transaction history from each wallet or exchange that you used during the tax year.

- Calculate Capital Gains and Losses: Use the detailed transaction history from each crypto wallet and exchange to calculate capital gains. You need to record each sale or disposition as a line item on Form 8949. Crypto tax software or an experienced crypto CPA can help with this process!

- Complete Schedule D: Use the totals from Form 8949 to complete Schedule D.

- Download Form 1099-MISC: Download the Coinbase 1099 from your account (if you received one).

- Report Ordinary Income on Schedule C: Use Schedule C to report ordinary income, such as Coinbase Earn rewards. You might be able to find this information on your Coinbase tax documents.

- Seek Guidance: Cryptocurrency taxes can be complex, especially if Coinbase isn’t your only crypto trading account. Consider using a professional to prepare your Coinbase taxes and provide qualified answers to your crypto tax questions.

Full-service Coinbase tax reporting

Our experienced crypto accountants are here make your Coinbase tax reporting easy and accurate! Save time, save money, and enjoy peace of mind with professional filing.

If you have any questions about your Coinbase taxes or how to report cryptocurrency, don’t hesitate to get in touch.