Reporting crypto taxes is more challenging than you may think. Many people don’t realize the tax burden they’re creating with their crypto activity. Meanwhile, the IRS has been cracking down on cryptocurrency taxes for years, so it’s important to understand how they work.

If crypto taxes are making you feel completely lost, you came to the right place!

Gordon Law Group is a leading crypto tax firm. We’ve been in cryptocurrency tax law since 2014, preparing more than 1,200 reports! With cryptocurrency accountants and crypto tax lawyers on our team, we make crypto tax filing easy and accurate.

Whether you’re a seasoned investor or a newbie, this guide will explain how crypto taxes work and how to report cryptocurrency on your taxes!

Do I Need to Report Crypto on My Taxes?

Absolutely. The IRS treats crypto assets like Bitcoin and Ethereum as property, not currency. This means that every crypto transaction you engage in—whether it’s trading, selling, or earning rewards—can have tax implications. Even if you lost money, it’s crucial to report all your crypto activities to avoid IRS problems.

How Is Crypto Taxed?

Cryptocurrency is taxable. The IRS taxes crypto as property, similar to stocks, so there are two main types of cryptocurrency taxes:

- Capital gains tax from trading

- Income tax from rewards or earnings

This applies to Bitcoin, altcoins, NFTs, stablecoins, and other digital assets.

Crypto Capital Gains Tax

Tax on crypto gains applies when you sell or trade cryptocurrencies. If the value of your crypto has increased since you bought it, you’ll owe taxes on any profit. This is a capital gain.

The capital gains tax rate depends on how long you held a specific asset before selling or disposing of it.

- Short-term gains apply to assets held for 1 year or less. The tax rate for short-term gains is the same as your ordinary income tax rate, from 10-37%.

- Long-term gains apply to assets held for longer than 1 year. The tax rate for long-term gains is 0%, 15%, or 20%, depending on your overall income level.

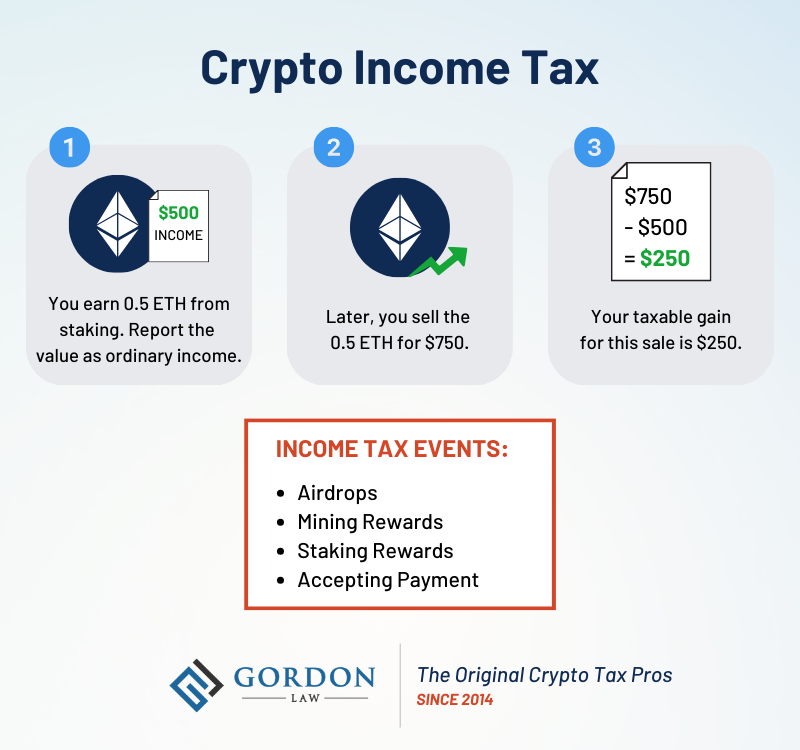

Crypto Income Tax

Generally, crypto income tax comes into play when you receive cryptocurrency in ways other than buying it. This includes receiving cryptocurrency as payment, mining, staking, interest, or any other form of earning. The IRS treats this income the same as wages from a job, with tax rates ranging from 10-37%.

So, how much income should you report for this type of crypto? The amount equals the fair market value in USD at the time you received the assets.

For example, let’s say you earn 0.5 ETH from staking. At the time you earn it, the price of 1 ETH is $1,000. In this case, you’ll report $500 of income.

If you then sell, exchange, or spend the coins, you’ll have a capital gain tax event. The amount you reported as income is also your cost basis. In the example above, the cost basis of the 0.5 ETH is $500.

What Is the Crypto Tax Rate?

The crypto tax rate depends on your income level, filing status, and types of activity. Rates range from 10-37% on short-term capital gains, 0-20% on long-term capital gains, and 10-37% on ordinary income.

Crypto Tax Rates for Short-Term Capital Gains and Ordinary Income (Tax Year 2023)

These rates apply to:

- Any sale or disposition of a crypto asset held for 1 year or less

- Crypto assets received as payment or through airdrops, mining, staking, and other forms of rewards

| Tax Rate | Single Filer | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $11,000 | $0 to $15,700 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $11,000 to $44,725 | $15,700 to $59,850 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $44,725 to $95,375 | $59,850 to $95,350 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,375 to $182,100 | $95,350 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,100 to $231,250 | $182,100 to $231,250 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 | $231,250 to $346,875 | $231,250 to $578,100 |

| 37% | $578,126 or more | $693,751 or more | $346,876 or more | $578,101 or more |

Crypto Tax Rates for Long-Term Capital Gains (Tax Year 2023)

These rates apply to any sale or disposition of a crypto asset held for more than 1 year.

| Tax Rate | Single Filer | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 0% | $0 to $44,625 | $0 to $89,250 | $0 to $44,625 | $0 to $59,750 |

| 15% | $44,626 to $492,300 | $89,251 to $553,850 | $44,626 to $276,900 | $59,751 to $523,050 |

| 20% | $492,301 or more | $553,851 or more | $276,901 or more | $523,051 or more |

Which Crypto Transactions Are Taxable?

You have to report most crypto transactions as taxable events. This includes more than just cashing out. Using crypto to purchase goods or services, or even trading one cryptocurrency for another, is taxable.

The following crypto transactions are subject to capital gains tax:

- Cashing out (selling crypto for USD/fiat)

- Converting or swapping crypto

- Paying for goods and services with crypto

- Trading crypto for NFTs or vice versa

The following cryptocurrency transactions are taxable as ordinary income:

- Mining or staking

- Receiving an airdrop

- Getting paid in crypto

- Earning interest, yield, or other types of rewards

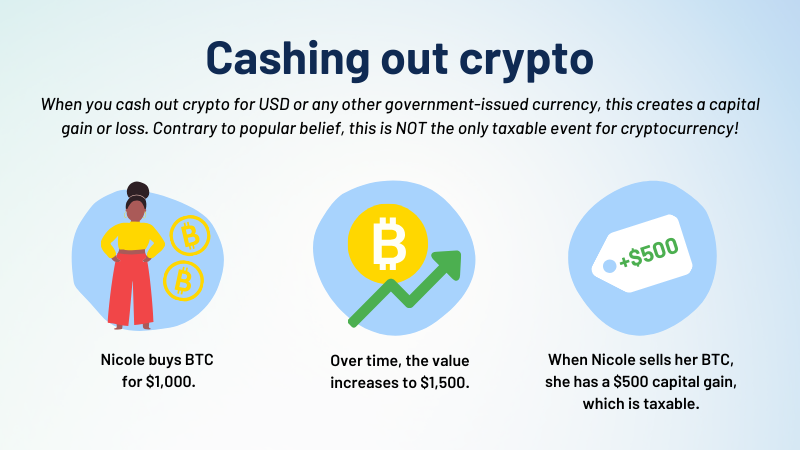

Do you pay tax when you cash out crypto?

Yes, cashing out your crypto—selling it for USD or any other type of government-issued currency—is taxable. This creates a capital gain.

Is converting crypto a taxable event?

Swapping one type of crypto for another (for example, trading ETH for ADA) is a taxable event. The IRS views this as selling the first coin for USD, then using USD to buy the second coin.

This is also true when converting to a stablecoin like USDC. It’s a very common mistake to think that crypto-to-crypto swaps are not taxable.

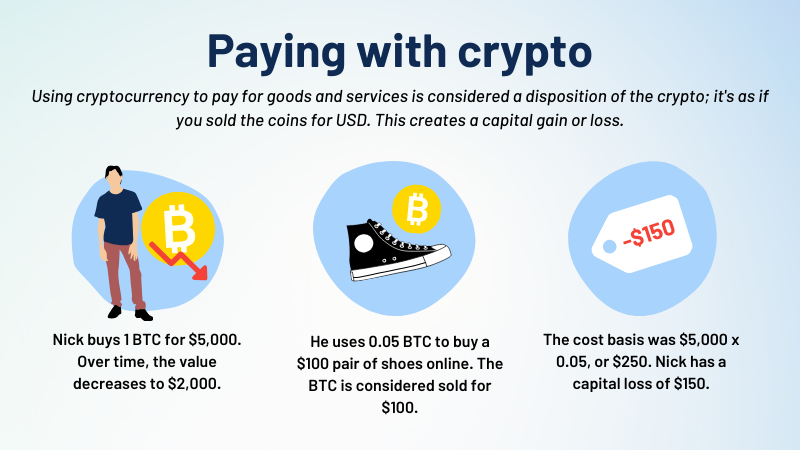

Is paying with crypto taxable?

Yes, using crypto to pay for something is a taxable event that creates a capital gain. This is true whether you’re buying physical goods, services, NFTs, or anything else.

Are there taxes on crypto mining?

Crypto mining is taxable as ordinary income. Typically, the IRS considers mining a business, which means that you can deduct business expenses. Learn more about taxes on Bitcoin mining or crypto mining.

Are crypto staking rewards taxable?

Yes, there are taxes on staking rewards. Unlike mining, the IRS doesn’t typically see staking as a business that allows tax write offs. Instead, they typically consider staking rewards as miscellaneous income. Learn more about taxes on staking rewards.

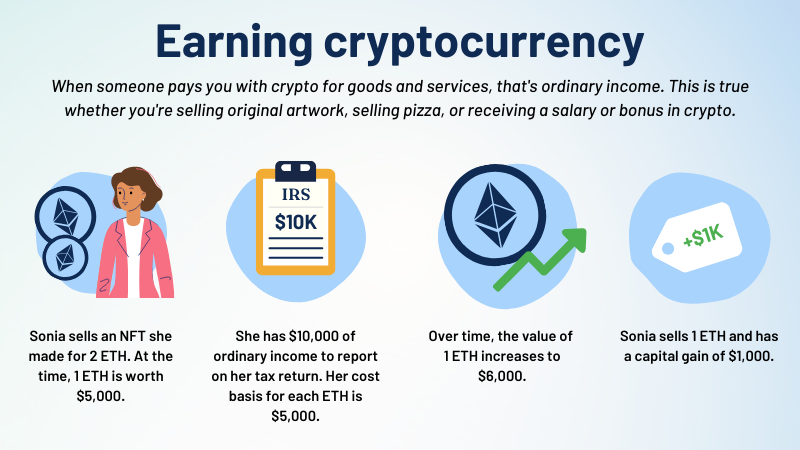

Are there taxes when you get paid in crypto?

When you receive payment in cryptocurrency, that’s taxable as ordinary income. This is true whether you’re accepting payment for original NFTs, physical goods, services, or anything else. It also applies if your employer pays your salary or bonus in crypto.

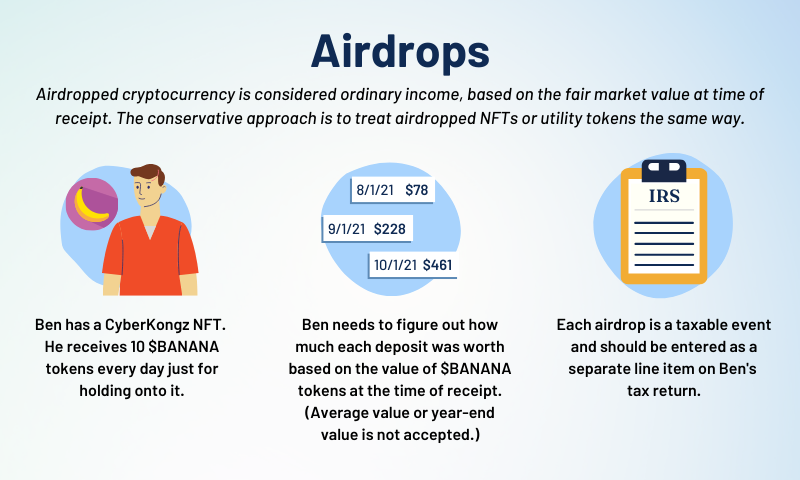

Are there taxes for airdrops?

Airdrops are taxable as ordinary income. The IRS guidance on airdrops only mentions cryptocurrencies (such as BTC and ETH). However, the conservative approach is to treat airdrops of NFTs or utility tokens the same way.

Is USDC taxable?

The IRS treats USDC and other stablecoins just like other cryptocurrencies for tax purposes. Trading them or converting them could trigger capital gains tax obligations.

Which Crypto Transactions Are Not Taxable?

There are some crypto transactions that are tax-free, but you may still need to report them. Non-taxable crypto transactions include:

- Purchasing crypto with USD/fiat

- Transferring crypto between your own wallets and exchanges

- Holding crypto, even if the value increases

- Giving or receiving crypto as a gift (within limits)

- Donating crypto to a qualified nonprofit

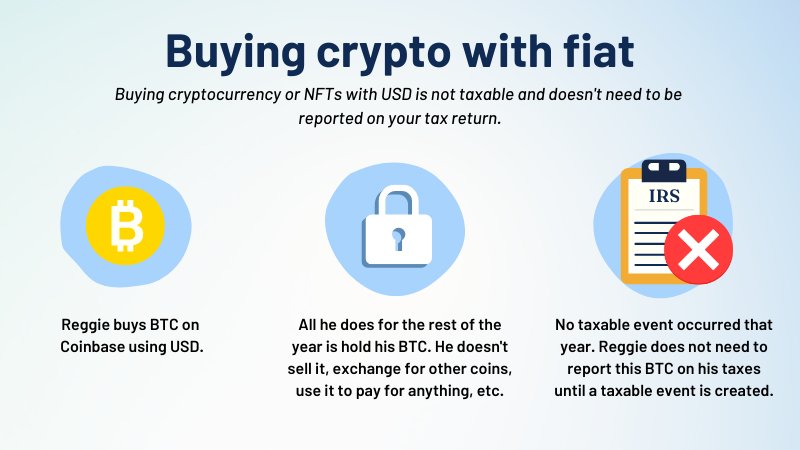

Is buying crypto a taxable event?

Simply buying crypto with USD or another government-issued currency is not taxable. You don’t have to check “yes” to the crypto question on your tax return if buying was your only activity.

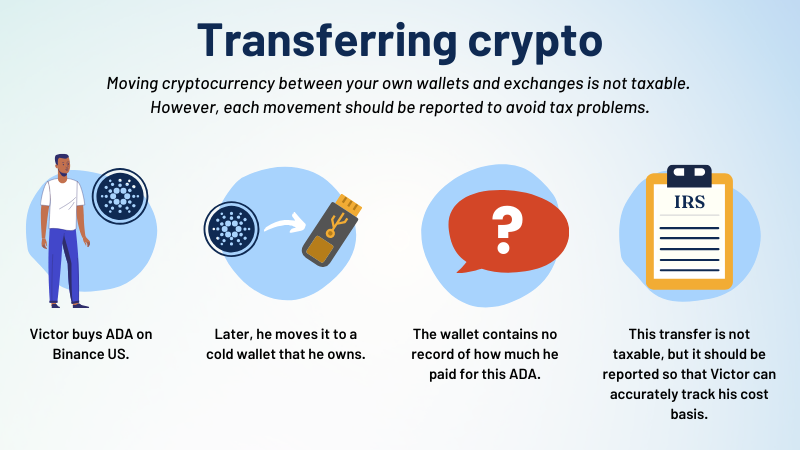

Is transferring crypto a taxable event?

Transferring crypto between your own wallets or accounts isn’t typically a taxable event. It’s more like moving your assets from one pocket to another. However, you still need to keep track of these movements so you can find the crypto cost basis.

It’s common for crypto tax software to mislabel self-transfers and count them as taxable transactions. Learn more about common problems with crypto tax software here, and contact Gordon Law Group if you need help!

If my crypto has gone up in value, do I have to pay tax?

You don’t have to pay taxes on crypto if you don’t sell or dispose of it. If you’re holding onto crypto that has gone up in value, you have an unrealized gain. This is non-taxable unless you have trader tax status. Once you sell, trade, swap, or otherwise dispose of the crypto, then you’ll have a taxable event.

Is sending crypto taxable?

Sending crypto as a gift is typically not taxable, as long as you don’t exceed annual or lifetime limits. However, you may need to send a crypto gift letter to the recipient or file a gift tax return. The gift also must be no-strings-attached and you must completely give up control of the cryptocurrency.

Sending crypto from one wallet to another is also not a taxable event. But if you’re sending crypto as payment for goods or services, that is taxable.

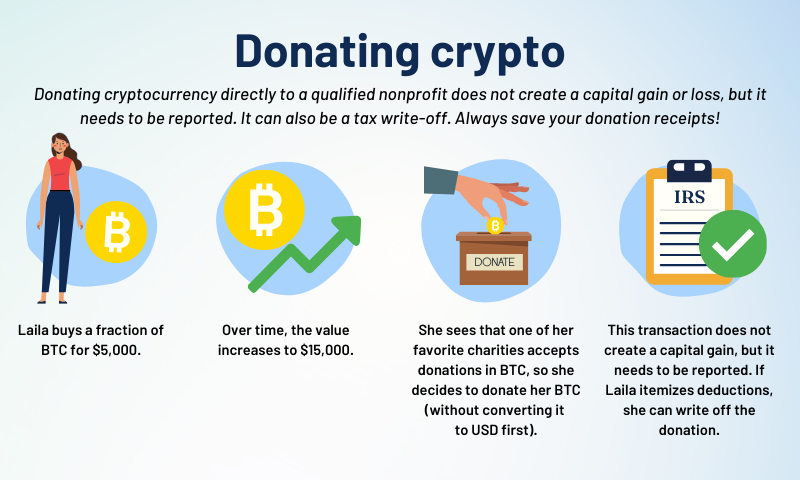

Is donating crypto taxable?

You can donate crypto to a qualified nonprofit without triggering capital gains tax. Plus, the donation can be tax deductible. This is a powerful way to avoid crypto capital gains tax.

Do I Have to Report Crypto If I Lost Money?

Yes, the IRS requires that you report crypto losses along with all other crypto activity. Believe it or not, this can save you a lot of IRS headaches. Cryptocurrency losses can offset gains and reduce your overall tax liability. It’s crucial to report both gains and losses accurately to ensure you’re not overpaying taxes.

Do Crypto Exchanges Report to the IRS?

Yes, many crypto exchanges report certain information to the IRS. When the IRS receives information about your crypto from an exchange, it’s critical that you report everything correctly.

Most exchanges currently use Form 1099-MISC or Form 1099-B. When it comes to crypto, these forms are often not sufficient for filing your taxes accurately.

Popular crypto exchanges that report to the IRS include:

- Coinbase

- Crypto.com

- Binance US

- Kraken

- Gemini

- Bitstamp

- Robinhood

- CashApp

- PayPal

Pro Tip: Soon, all cryptocurrency “brokers,” including decentralized exchanges and certain types of wallets, will have to submit Form 1099-DA. Once that happens, the IRS can begin a crypto tax audit spree. It will be much easier for them to find taxpayers with unreported crypto.

What Happens If I Don’t Report Crypto on My Taxes?

If you fail to report your crypto transactions accurately, you can face serious consequences. These include cryptocurrency tax audits, severe financial penalties, and even criminal tax investigations.

The IRS has been actively targeting crypto tax evasion for years. Soon, the IRS will start collecting much more information on Form 1099-DA. Report your activities correctly to avoid problems.

Gordon Law Group can help you correct past mistakes. Give us a call now if you’re worried about your crypto tax reporting!

How to Avoid Crypto Taxes

You may not be able to completely eliminate cryptocurrency taxes, but you can take advantage of many strategies to reduce them. Learn how to avoid capital gains tax on crypto.

Gordon Law Group offers skilled tax planning services to crypto traders. We can help you craft the best strategies for your specific situation.

How to Report Crypto on Taxes

Accurately reporting cryptocurrency on your tax return is essential to stay compliant and avoid potential issues with the IRS. Here’s a step-by-step guide on how to file crypto taxes:

- Gather Your Crypto Tax Documents: Collect all records related to your crypto transactions. Start with any tax documents from cryptocurrency exchanges. You should also download your full transaction history from each exchange, wallet, or account you used during the year.

- Calculate Your Gains and Losses and Complete Form 8949: For each transaction, calculate the capital gain or loss. Use this information to complete Form 8949. To simplify this process, consider using specialized crypto tax software or hiring an experienced crypto tax accountant.

- Transfer Totals to Schedule D: Done with Form 8949? Add the totals from each section to Schedule D. This is where you summarize your capital gains and losses.

- Report Ordinary Income: If you earned cryptocurrency as income, report it on Schedule C of Form 1040. This information is often, but not always, reported by exchanges on Form 1099-MISC. Be sure to include all relevant income sources.

- Seek Professional Advice: Consulting a tax professional with experience in cryptocurrency taxation can provide you with peace of mind. Many areas of crypto taxation require legal analysis.

By following these steps, you can report crypto on your taxes accurately and confidently! If you run into any problems with your crypto tax filing, call Gordon Law Group. We help you save time and money with easy and accurate crypto tax reports!

Best Way to Do Crypto Taxes

Looking for the best way to do your crypto taxes? If you trade frequently or have complex activity, hiring an experienced crypto accountant is the best choice. Gordon Law Group provides easy and accurate crypto tax reports, and we can file the rest of your tax return, too!

Crypto tax software can help you calculate your cost basis and prepare a report that’s ready to file. However, it’s not always as quick and easy as you may think. Depending on your activity, it can take several hours to fix software errors and get an accurate report.

Common problems with cryptocurrency tax software include:

- Unable to account for NFTs and DeFi transactions

- Unable to connect to niche chains

- Incorrectly labeling self-transfers as taxable transactions

- Inflating your taxable income

Gordon Law Group provides advanced troubleshooting for all crypto tax software. If you can’t get the software to work, save time and money by contacting our skilled crypto accountants!