If you received transactions from foreign trusts or entities during the tax year, you may need to file Form 3520. In an effort to prevent tax evasion, the IRS has increased the number of offshore penalties they issue, so failure to file this form on time can lead to steep penalties.

Are you wondering whether you’re required to file Form 3520? It can get tricky to understand the rules; the IRS only requires foreign transactions of specific amounts to be reported.

But that’s why we’re here! By the end of this article, you’ll know what IRS Form 3520 is, who should file it, and the potential penalties you could face if these requirements aren’t met.

What is Form 3520?

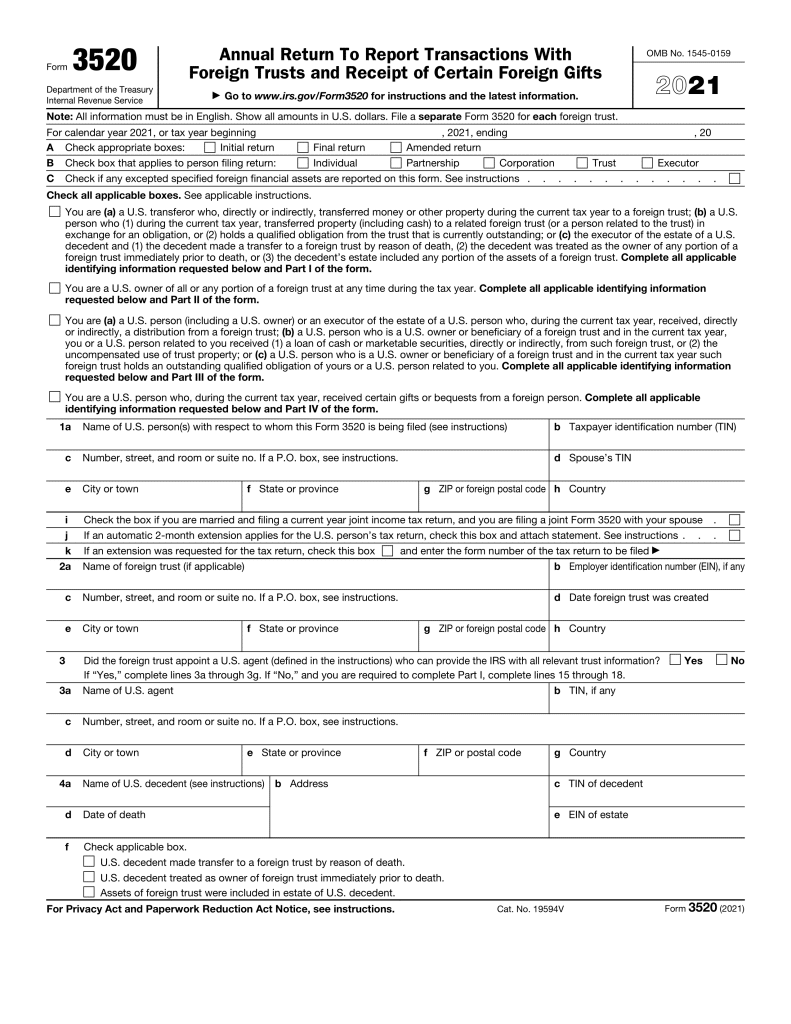

Form 3520, also known as the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, is an informational return used to report transactions involving foreign trusts, entities, or gifts from foreign persons.

This form is filed annually with your tax return. You can trigger an IRS audit and penalties if you don’t file it on time.

Who Needs to File Form 3520?

Form 3520 may not be required of every US citizen who receives a foreign gift. The value of the gift and who sent it to you are important factors in determining whether you need to file.

The IRS requires the following information to be filed:

- Ownership of foreign trusts

- Certain transactions with foreign trusts (see next section)

- Receipts of large gifts from foreign entities or people

Form 3520 Instructions

Let’s say you just received a $1,500 check from your grandparents, who are enjoying their retirement in the hills of Italy. Now you’re wondering if the IRS will want a piece of the pie and if this counts as a “reportable event.”

You need to file IRS Form 3520 if:

- You were a part of a “reportable event”

- The creation of foreign trust by a US citizen

- The transfer of money or property to a foreign trust by a US citizen

- The death of a US citizen or resident who was the owner of a foreign trust

- You are a US owner of assets of a foreign trust during the tax year

- Your directly or indirectly received assets from a foreign trust, including property

- You are a US citizen who received:

- More than $100,000 from a foreign person or entity as a gift or bequest

- More than $15,000 from a foreign corporation or partnership that you treated as a gift

You should expect to file a separate Form 3520 for each foreign trust you own or have an interest in.

If you and your spouse are filing joint returns for the tax year and are both beneficiaries of the same foreign trust, you can file a joint IRS Form 3520.

What Is the Filing Deadline for Form 3520?

If you have reportable activities, it’s important to remember IRS Form 3520 is due at the same time as your annual tax return.

- For most individual taxpayers, this due date is April 15 unless approved for an October 15 filing extension

- The filing due date for partnerships is March 15

IRS Form 3520 Penalties

It can be a hassle to figure out how to file correctly or whether you even need to file it—but that won’t stop the IRS from assessing harsh penalties! We highly recommend that you team up with one of our award-winning FBAR attorneys to help you get the job done error-free.

Failing to file or incorrectly filing IRS Form 3520 can result in hefty IRS penalties. The general fine for these violations is $10,000 or 5% of the gross value of all unreported assets, whichever is greater.

The fines can potentially increase if a US citizen fails to report any property or distributions transferred to their foreign trust. The general fine for this is $10,000 or 35% of the gross value of the unreported assets, whichever is greater.

If you’ve found yourself up against these penalties, we may be able to eliminate them. Don’t worry—we can help you find light at the end of the tunnel!

Hassle-Free Filing with Gordon Law Group

That was a lot of information, but if you’re still confused about how to start, we’ve got your back! Contact us today and let our team of attorneys help you avoid tax debt!

Don’t wait until the deadline approaches; call Gordon Law Group today for peace of mind when it’s time to submit.