So, you tried to hide some money from Uncle Sam and now you’re worried the IRS may come knocking at any minute.

Did you know there’s a way for you to avoid facing any jail time? Although it may sound too good to be true, the IRS does offer a way to clear your name through the IRS Voluntary Disclosure Program (VDP).

The Voluntary Disclosure Program allows qualifying taxpayers to disclose their unreported foreign accounts, assets, cryptocurrency, and other investments—and hopefully avoid criminal charges.

Do you have unreported income that’s keeping you up at night? Help is on the way! Here’s what you need to know about IRS voluntary disclosure.

What is the IRS Voluntary Disclosure Program?

The IRS Voluntary Disclosure Program, or VDP, can be a huge benefit for taxpayers who have committed tax or tax-related crimes and are considered willful by the IRS.

It gives you a chance to right your wrongs, pay the tax and penalties owed, and avoid criminal prosecution.

You may have heard of a previous program called the Offshore Voluntary Disclosure Program (ODVP).

The VDP replaced the OVDP in 2019 and covers more types of tax deficiencies than its predecessor.

Unlike the ODVP, the IRS Voluntary Disclosure Program is not limited to funds or assets held overseas.

Applying for the IRS Voluntary Disclosure Program doesn’t mean you’re granted immunity from any tax penalties and interest you may have accrued.

But it does significantly lower the chances of criminal prosecution! Many clients would rather go this route than continue to risk jail time.

Keep in mind that the IRS could shut down this program at any time. If you’re thinking about using the VDP to wipe your slate clean, don’t wait! Speak to our experienced tax attorneys today.

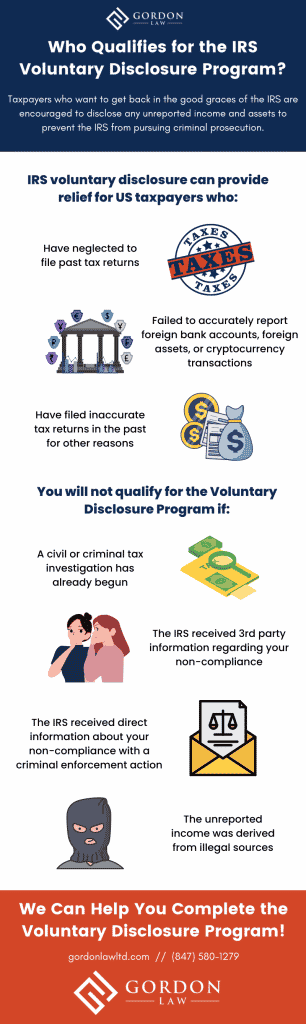

Who Qualifies for the IRS Voluntary Disclosure Program?

If you have committed a tax-related crime and are considered willful by the IRS, the VDP may be for you!

Taxpayers who want to get back in the good graces of the IRS are encouraged to disclose any unreported income and assets to prevent the IRS from pursuing criminal prosecution.

IRS voluntary disclosure can provide relief for US taxpayers who:

- Have neglected to file past tax returns

- Have failed to accurately report foreign bank accounts, foreign assets, or cryptocurrency transactions

- Have filed inaccurate tax returns in the past for other reasons

The VDP is all about being proactive. If you wait until the IRS reaches out, you’re already too late.

You will not qualify for the Voluntary Disclosure Program if:

- A civil or criminal tax investigation has already begun

- The IRS received third-party information regarding your noncompliance (for example, information from a foreign bank, from a cryptocurrency platform, released following a John Doe summons, or former business partner)

- The IRS received direct information about your non-compliance with a criminal enforcement action (subpoena, grand jury, or warrant)

- The unreported income was derived from illegal sources. Contact us for a confidential consultation if this is the case

How to apply for IRS Voluntary Disclosure

The Voluntary Disclosure Program application is a complex process with high stakes. Because of the criminal concerns involved with VDP filings, it is strongly recommended to have an experienced tax attorney guide you through.

Here are the steps of applying for the VDP:

Form 14457

The voluntary disclosure process begins with Form 14457, Voluntary Disclosure Practice Preclearance Request and Application. The form must be submitted in 2 parts.

Part I: Disclose your past tax deficiencies, including any previously undisclosed funds and their initial sources.

You must submit Part I first in order to obtain preclearance.

Part II: This is the actual VDP application; it covers more details about your unreported income, along with a written statement explaining your story to the IRS. Once your preclearance request (Part I) is accepted, you have 45 days to submit Part II or make a written request for additional time.

Audit and amended filings:

If your application is accepted, the IRS will assign an examiner to your case for an audit. You’ll need to submit the correct version of your last 6 tax returns, along with all supporting documents. The examiner may require an interview, as well.

You must also comply with any FBAR or foreign trust reporting requirements over the last 6 years.

Closing letter:

If you successfully complete the Voluntary Disclosure Program, you’ll receive a closing letter detailing which parts of your records have changed and the penalties you agree to pay.

This comes as close as possible to a guarantee from the IRS that you won’t be further audited or criminally prosecuted for the tax years you disclosed through the VDP.

Can I use the VDP for unreported cryptocurrency?

The IRS recently updated Form 14457 to include a section for unreported cryptocurrency income.

Maybe you just started in crypto and didn’t know how to report it correctly. If you need help understanding crypto taxes, check out our Crypto Tax Guide for answers!

How much will I have to pay?

While the IRS Voluntary Disclosure Program can protect taxpayers from criminal investigation, it doesn’t provide relief from financial penalties.

In exchange for a less risk of being prosecuted, you will be required to:

- Pay in full the tax and interest on the past 6 years of tax deficiencies

- Pay a civil fraud penalty of 75% on the highest tax deficiency year out of the past 6

- Pay a one-time FBAR penalty for failing to file any FBARs disclosed through the VDP

The one-time FBAR penalty, assessed through the VDP, is typically 50% of the highest aggregate balance for the period you’re disclosing, or $100,000, whichever is greater.

Example: A year ago, your accounts reached their peak value at $3 million. Today, they’re worth $2.5 million. The penalty would be 50% of $3 million.

An IRS payment plan can be established if you cannot pay the deficiency after completing the voluntary disclosure application.

The tradeoff is peace of mind. Unless the IRS uncovers false information or illegal activity in your VDP process, they are unlikely to recommend criminal prosecution for your case once you complete the program.

What are my other options?

The Voluntary Disclosure Program is not the only way to correct your tax situation.

Most taxpayers consider it a last resort because of the steep penalties involved. Some of the other options include:

- Streamlined Foreign Offshore Procedure: This is often the best option for those who qualify. With the Streamlined Foreign Offshore Procedure, you will only have to pay the balance of the taxes you owe and interest, with no additional penalties.

- Streamlined Domestic Offshore Procedure: If you don’t qualify for the Streamlined Foreign Offshore Procedure: This may be a good program for you. Upon completing the procedure, you’ll have to pay a standard penalty in addition to the balance of what you owe and interest.

- Quiet Disclosure: We can help you amend your past tax returns and refile them without going through an official IRS program. We don’t typically recommend this course since it can carry heavy penalties. The IRS tends to be more forgiving when you go through an official disclosure process.

At the end of the day, it’s up to each individual’s level of risk tolerance. Some people choose to do nothing and hope the IRS won’t uncover their tax delinquency.

We highly recommend not taking this route, as it carries the highest risk of penalties and criminal charges from the IRS.

If you aren’t sure what to do next, contact our team of tax attorneys to help!

We can help you complete the Voluntary Disclosure Program!

We’ve had countless clients say they can’t sleep at night for fear of what the IRS might do to them.

The VDP lets you close the book on past tax delinquency and start fresh.

Don’t wait until it’s too late! Call Gordon Law Group today at (847) 787-9346.

We can help you get started with the VDP and walk you through every step along the way.