5 Tips If You Can’t Pay Your Tax Bill

When the IRS deadline is approaching and you can’t pay your tax bill, what should you do? Here are 5 tips from seasoned tax attorneys.

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

When the IRS deadline is approaching and you can’t pay your tax bill, what should you do? Here are 5 tips from seasoned tax attorneys.

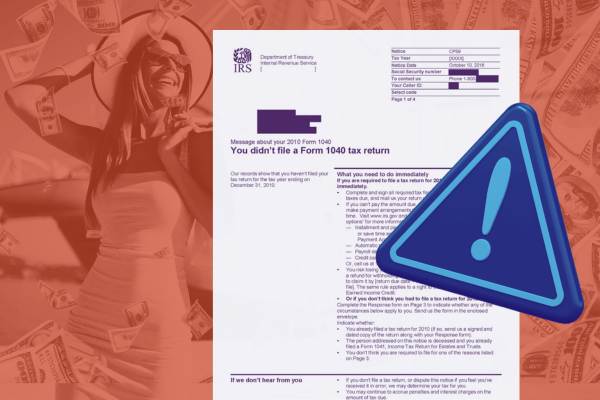

The IRS is targeting wealthy non-filers who haven’t filed tax returns between 2017 and 2021. Learn what you should do if you receive Notice CP59.

If you’re facing IRS wage garnishment, you may feel confused, angry, and overwhelmed. But you have options! Learn how to stop the IRS garnishing your wages.

Are you struggling with Illinois Department of Revenue collections? Do you have overwhelming Illinois tax debt that you can’t afford to pay? You have options, and our Chicago tax law firm can help!

Did you receive a CP2000 letter about cryptocurrency taxes? We can help!

Are you a Robinhood or BlockFi user who’s received IRS letter CP2000? This is the start of a crypto tax audit. Here’s what you need to know.

You may be eligible for automatic penalty relief and other tax debt relief options. Learn more here, and reach out to discuss your options.

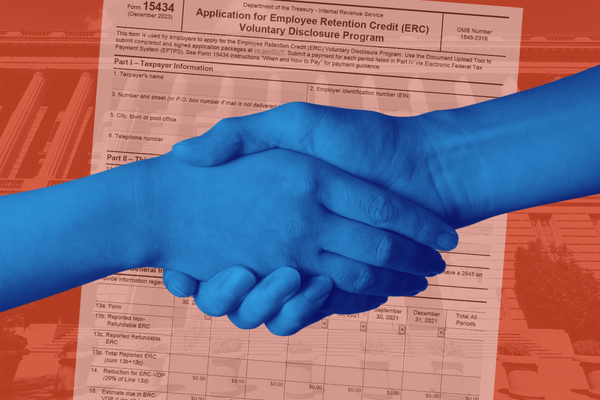

Get tax relief while you can! For a very limited time, the IRS is offering employers relief for repayment of the Employee Retention Credit (ERC). The new Voluntary Disclosure Program offers a significant discount on the tax owed, plus a waiver of interest and penalties.

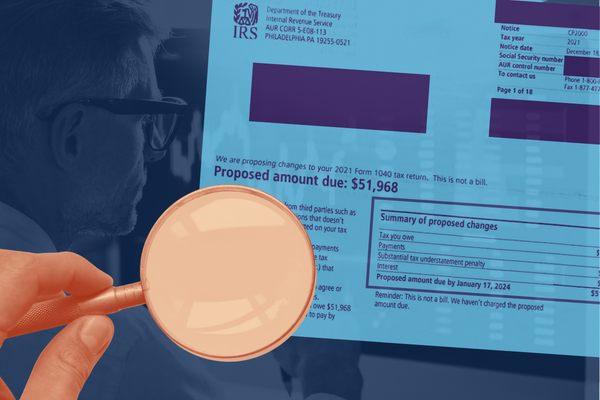

Did you get a CP2501 letter from the IRS? The amount listed may not be correct. Discover what you should do with this notice!

The Inflation Reduction Act gives the IRS an additional $80 billion per year to increase services and collections.

For married couples filing joint tax returns, “through thick and thin” can refer to more than just wedding vows. You’re

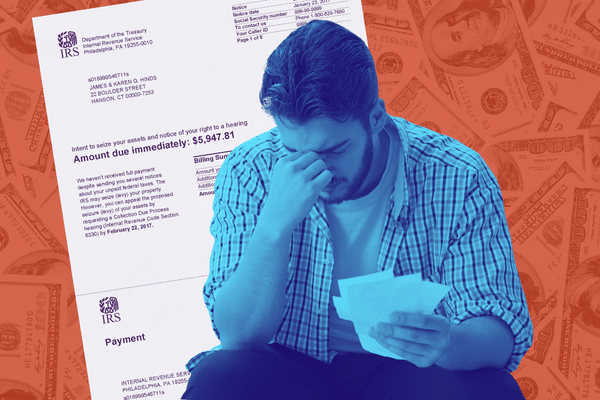

So you’ve received the notice that every taxpayer dreads: You owe the government money! Fortunately, the IRS allows qualified taxpayers

Offshore accounts were once the go-to option for Americans who wanted to hide money from Uncle Sam. Those days are

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279