Drowning in tax debt? You may find relief via an IRS Offer in Compromise, or OIC—an option that allows taxpayers to reduce outstanding IRS tax debts.

But be warned: The rules are inflexible and messing up can be costly. It’s best to work with a professional tax attorney who has intimate knowledge of the OIC program and will fight for your rights.

What is an Offer in Compromise?

An IRS Offer in Compromise, or OIC, is a way for taxpayers to find relief if they can’t afford to pay their outstanding tax debts. Essentially, you can offer a reasonable repayment plan to the IRS and potentially settle for less than you actually owe.

An Offer in Compromise is not the only way to pay off your tax debt, and in many cases, it’s a last resort. Read on to see if an OIC is a good solution for your tax problems, or call our experienced tax attorneys at 847-281-3436 for a confidential consultation.

Offer in Compromise requirements

The requirements for an Offer in Compromise are strict. The IRS accepts only about 40% of OIC requests, according to data from 2017.

There are 3 reasons the IRS will consider your Offer in Compromise:

- Doubt as to Collectability: If you’re unable to pay your full tax bill, you can submit this type of Offer in Compromise.

- Doubt as to Liability: You can file this type of OIC when there’s solid reason to believe you don’t owe the full amount the IRS is trying to collect.

- Effective Tax Administration: If you could pay the amount you owe, but have extreme extenuating circumstances for not doing so, you may be able to file this OIC. If paying your full tax bill would cause “economic hardship” as defined by the IRS , you may qualify for this option.

Whichever situation applies, you’ll need to provide substantial evidence of your claims when you submit your Offer in Compromise. You’ll also have to meet these standard OIC requirements:

- You’ve filed all required tax returns. If not, you should go back and file your late tax returns before submitting your OIC.

- You’ve made payments on your tax debt. The IRS will not consider your offer if you haven’t made required estimated payments in the current tax year. Pausing your monthly or quarterly payments while you wait for an OIC to be accepted won’t put you on the IRS’s good side.

- You aren’t filing for bankruptcy. If you or your business are in an open bankruptcy proceeding, the IRS will reject your offer.

- You aren’t undergoing an audit. You won’t qualify for an OIC if you have an open audit investigation or Innocent Spouse Relief claim with the IRS.

- Your case hasn’t been referred to the Department of Justice. If the IRS finds evidence of criminal tax evasion, they’ll refer your case to the Department of Justice to recommend criminal prosecution. If your case is already in the hands of the DOJ, it’s too late to file an Offer in Compromise, but you should absolutely call our tax attorneys at 847-281-3436 to learn how we can help.

The IRS has a handy Offer in Compromise pre-qualifier tool to help you see if you’re eligible to file an offer.

How much should I offer in an OIC?

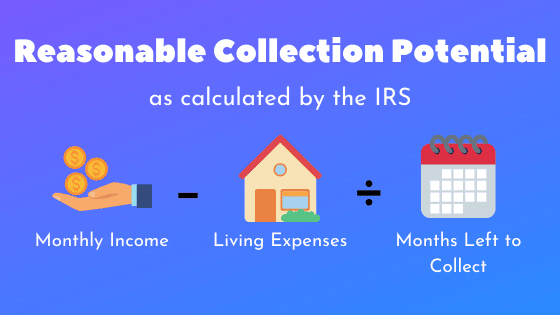

Now, there’s the million dollar question. An Offer in Compromise should equal or exceed what the IRS considers your “reasonable collection potential”–in other words, how much the IRS believes they can actually get from you within the 10-year collection window.

Your collection potential is calculated by a standard formula, and the IRS won’t accept lowball offers.

The formula for your “reasonable collection potential” is simple: Your monthly income (and future monthly income), minus allowable living expenses, times the number of months the IRS has left to collect your debt. Income includes not only wages, but any valuable assets you own: your home, car, furniture, even art and jewelry.

If your reasonable collection potential is less than your tax bill, your Offer in Compromise will likely be accepted. However, the gap between what you and the agency consider to be “reasonable allowable living expenses” can be cavernous.

How to calculate allowable living expenses for an IRS OIC

The IRS doesn’t play around when it comes to calculating your allowable living expenses. The agency sets strict limits on how much you can claim for these common expense categories:

- Housing costs: The allowable limit for housing costs (including rent or mortgage and all utilities) is based on your county and the number of people in your household.

- Car payments or public transportation: The limit is standard no matter where you live. As of March 2020, that amount is $508 per month for a single car or $217 per month for public transit.

- Car operating expenses (gas, insurance, and maintenance): This limit depends on your location, but it’s typically around $200-300 per month for a single car.

- Monthly out-of-pocket medical costs: The IRS automatically allows $52 per month for each member of your household with no questions asked (or $114 per month for each member over 65). You may be able to raise this limit with supporting documents from your doctor.

- Food, clothing, entertainment, and personal care: No matter where you live, the IRS has a standard per-person limit based on the number of people in your household.

The IRS limits for allowable living expenses are typically much less than what taxpayers actually spend.

Let’s use Cook County, Illinois as an example.

The IRS allows a 2-person family living in Cook County, Illinois $2,119 per month for housing and utilities expenses (IRS guidelines 2019). That figure is supposed to cover rent or mortgage, insurance, property taxes, maintenance and repair expenses, garbage collection, heating, water, electric, gas, residential phone service, cell phone service, Internet, and cable television. But the average cost for a 2-bedroom apartment in Chicago is around $2,165 (January 2020) for rent alone.

If your actual spending is over the allowable limit and you’re filing an OIC on your own, the IRS won’t be very flexible. Any amount over their cap will be counted as cash flow that you can use to pay off your tax debt, unless you have a skilled tax attorney to negotiate on your behalf.

At the end of the day, the IRS knows that a lower payment agreement you can stick to is better than a higher payment agreement you won’t be able to deliver, but it takes a lot of complex calculations and negotiations to come up with an Offer in Compromise that works for you and the IRS.

Filing an IRS Offer in Compromise

To file your Offer in Compromise with the IRS, you’ll need to…

- Use the Offer in Compromise formula to calculate your offer

- Submit your repayment terms using Form 656

- Use Form 433-A to provide a detailed picture of your income and living expenses, along with documents to support your numbers

- Pay the $186 fee to submit your request

- You don’t have to pay this fee if you’re filing a Doubt as to Liability OIC (you’re contesting the amount you owe to the IRS)

- You may also be able to waive the fee if you meet the IRS’s low-income guidelines

- Make the first payment for your offer. There are 2 payment options:

- Lump sum: Include 20% or more of your offer amount. If the IRS accepts your offer, you’ll need to pay the remaining balance in 5 payments or less starting at the acceptance date.

- Periodic payment: Include your first payment with your OIC request and pay the remaining balance in 6 to 24 months (depending on the terms of your offer) from the time you file the request. You’ll have to keep making these payments while the IRS is processing your offer, or it will be rejected.

- Whether or not your Offer in Compromise is accepted, these payments and your $186 application fee will be applied toward your tax debt.

If the IRS rejects your offer, you can try again, but you’ll have to pay the application fee and initial payment each time you file the request. Make sure you hire a professional and get it right the first time.

What happens if my OIC is accepted?

If the IRS accepts your Offer in Compromise, you’ll have to stick to the repayment plan you offered.

Otherwise, the IRS can sue you to collect the original debt plus interest and penalties. That’s why you should calculate your OIC amount carefully with the help of an experienced tax attorney.

You also need to continue filing your tax returns on time and paying any future tax bills for the next 5 years. If you fail to do this at any point in the 5-year window, the IRS will void your OIC agreement.

Use a responsible OIC tax attorney

A good tax attorney will offer realistic advice for your Offer in Compromise and secure your best outcome.

It is possible to significantly lower your tax debt, but don’t trust lawyers who claim they’ll erase your IRS debt completely. The IRS is out to collect as much tax revenue as possible and they will not accept an offer of $0.

If you’re considering an Offer in Compromise, you need an attorney who will fight for your rights, deliver the lowest tax bill possible, and be honest about what you can expect. Call the experienced attorneys at Gordon Law Group and see how we can help you find relief from the overwhelming stress of IRS debt.