Are you an investor or creator in the world of non-fungible tokens (NFTs)? If so, you need to understand the tax implications of NFT transactions.

Whether you’re buying and trading NFTs for investment or selling original NFTs, failing to comply with tax regulations can lead to steep tax penalties, audits, and worse. That’s why we’re here to help with this comprehensive guide to NFT taxes! So if you want to stay on top of your tax obligations and avoid any potential IRS headaches, keep reading!

NFT taxes are extremely complex, so if you need help calculating your taxes owed or filing your return, call the original crypto tax professionals at Gordon Law Group at (847) 580-1279. We make your crypto, NFT, and DeFi taxes completely stress-free!

What is an NFT?

Non-fungible tokens or NFTs are unique digital tokens used to authenticate and exchange intellectual property such as photos, videos, real estate, and music.

Unlike fungible cryptocurrency tokens such as Bitcoin and Ethereum, the value of an NFT is derived from being a one-of-one.

Each NFT has a unique ID embedded in the blockchain with a history of who minted it and every previous owner.

How Do NFT Taxes Work?

As of right now, the same tax principles that apply to trading cryptocurrency also applies to NFT trading.

For tax purposes, NFTs are treated as a form of property like stocks, bonds, and real estate.

The following crypto-to-crypto transactions are considered taxable events:

- Buying an NFT with fungible cryptocurrency

- Selling an NFT for fungible cryptocurrency

- Trading an NFT for another NFT

For NFT professionals (artists & businesses), this may not be the case. Income earned through transactions will be considered ordinary income.

Here’s what both investors and creators should know about NFT taxes and how they work.

Capital Gains

The IRS treats digital assets like property (similar to stocks). For most crypto and NFT investors, the majority of taxes come from capital gains.

Back in 2011, Bitcoin was worth so little you could have won 10 BTC in a hot dog eating contest. Now, those 10 coins can buy you a respectable house in the suburbs, or maybe a dusty closet in Brooklyn. This change in crypto’s value can create a capital gain (if you sell crypto for a profit) or a capital loss (if you sell it for less than you initially paid).

Lots of people think you can only trigger a capital gain or loss by cashing out your crypto, but that’s just not true.

All of these actions create a capital gain or loss:

- Cashing out cryptocurrency for USD or other fiat currency

- Purchasing goods or services with cryptocurrency: Whether you’re buying an NFT, paying your crypto-savvy accountant, or finally getting that Lambo, this is considered a “sale” of the crypto.

- Trading one type of crypto for another: Yep, this type of trade (like swapping BTC for ETH) is taxable. It’s as if you sold the BTC for cash and then used cash to buy ETH.

- Using tokens to vote on projects, tip creators, or award members of a community. If you’re getting rid of the token, it’s probably a sale.

The fact that all these activities are taxable is bad news for lots of investors who’ve been running around swapping coins, not realizing they need to calculate their gains on every single trade.

Unfortunately, the IRS isn’t sympathetic. The burden is on you, the taxpayer, to figure it out.

So how do you do that? How much tax do you have to pay when you use your crypto to buy a twerking Pepe the Frog GIF? Well, it depends on how long you held the asset. Short-term capital gains (for assets held less than 1 year) are taxed at the same rate as your ordinary income.

Under current law, long-term capital gains (for assets held more than 1 year) are taxed at 0%, 15%, or 20%, depending on how much money is in this category.

Ordinary Income

Crypto interactions include more than simply buying and trading. Sometimes, you might earn crypto in exchange for work, and sometimes, coins will randomly appear in your account like a U2 album on an unsuspecting iPhone.

These types of transactions create ordinary income, and they include:

- Airdrops

- Getting paid in cryptocurrency for goods or services (including getting paid for an NFT you created)

- Rewards from mining or staking

- Interest earned in the form of cryptocurrency

Ordinary income also includes things like your regular old paychecks, freelancing income, etc. Your level of income determines your income tax bracket.

Sometimes, crypto can be considered business income—like if you’re selling original NFTs, mining or staking, or receiving crypto payments for goods and services. In that case, you can also deduct business expenses.

When you have business income and expenses to report, it’s usually a good idea to have your tax return done professionally.

NFT Taxes for Investors

Most people dealing with NFTs fall into the category of investors. This includes anyone involved in the buying and selling of NFTs in the open market. For investors, NFT taxes work the same as taxes on cryptocurrency trades.

Buying NFTs

Buying NFTs with cryptocurrency is a taxable event and is subject to capital gains/losses.

For example, Kate purchases an NFT valued at $1,200 (1 ETH) in February 2022. She used 1 ETH purchased at $400 two years ago to make the purchase.

Since she purchased the NFT in February, she incurred a long-term capital gain of $800 ($1,200 – $400). This is considered a long-term gain because she held the ETH for over 12 months before using it to purchase the NFT.

Selling NFTs

Selling an NFT in exchange for cryptocurrency, fiat, another NFT, or any good/service is considered a taxable event.

If Kate were to sell this NFT in December 2022 for $9,000, she would have a short-term capital gain of $7,800 ($9,000 – $1,200). In this case, the gain is short-term because she held on to the NFT for less than 12 months before selling.

Tax-Loss Harvesting Strategies for NFT Investors

Tax-loss harvesting is a common strategy used by investors in almost all asset classes, and NFTs are no different. In fact, NFTs may represent one of the best opportunities to utilize tax-loss harvesting.

Seeing the value of so many NFT projects plummet can be harsh, but tax-loss harvesting can be a silver lining that can save thousands on your tax bill. Of course, it can be a challenge to liquidate NFTs whose value has hit rock bottom, but that’s where our friends at Unsellable NFTs and NFT Loss Harvestooor come in.

These tools allow you to sell illiquid NFTs in order to realize a loss and lower your capital gains. Take a look at our guide to Crypto Tax-Loss Harvesting to learn more!

What If I Purchased Crypto Just to Buy an NFT?

If you purchase cryptocurrency and immediately use it to buy an NFT, and there is no change in the crypto’s value, you’re still required to report this transaction to the IRS.

Keep in mind that a cryptocurrency’s value can change by the second so there typically may be a small gain/loss.

What If I Use US Dollars to Buy an NFT?

If you use fiat (USD or other traditional currency) to purchase an NFT, then you have simply purchased property. This does not trigger any type of income tax.

Pooling Funds to Buy NFTs

What if you pool your money with some friends and purchase an NFT together? Although it’s easy to make this kind of transaction, it’s a little tricky to report it correctly on your taxes. It’s much more complicated than you may initially realize.

It’s best practice to set up an LLC with its own separate accounts before purchasing NFTs with someone else. The individuals pooling their funds would be owners of the LLC.

Reselling or trading the NFTs will create capital gains or losses, and it’s much easier to keep track of all that if you properly set up a business. But if you’ve already pooled funds to purchase NFTs, and you’ve been using personal wallets, don’t worry; you can fix it.

Here’s how each person might report that on their tax returns:

- Elyse and Adrian decide to buy an NFT together. They’ll each contribute 0.5 ETH for the purchase.

- Adrian sends 0.5 ETH to Elyse, and Elyse uses the combined funds to buy an NFT for 1 ETH.

- Elyse should account for the “sale” of 1 ETH that was used to buy the NFT. 0.5 ETH was her own, so she should have the cost basis for that portion.

- For the 0.5 ETH that Adrian sent, Elyse can use the fair market value at the time she received it as the cost basis; therefore, when this ETH was sold to buy the NFT, there was no capital gain.

- Adrian can report his 0.5 ETH as sold to Elyse; the proceeds are based on the fair market value at the time he sent it.

- Depending on his cost basis, he’ll have a capital gain or loss to report.

- Alternatively, it is possible that the IRS would consider the pooling of funds as a partnership and require you to file a partnership tax return.

- Going forward, Elyse and Adrian should set up an LLC and create a separate business account before doing any other transactions.

NFTs and Airdrops

Sometimes, owners of specific NFTs are awarded airdrops of other tokens. For example, owners of Cool Cats NFTs receive MILK tokens.

While the IRS has not issued guidance on NFT-specific airdrops, they have provided clarification on airdrops in general. Airdrops of cryptocurrency are considered ordinary income, with tax based on the USD value at time of receipt.

Play-to-Earn Games & In-Game NFTs

Games like Axie Infinity, Guild of Guardians, Aavegotchi, and many more allow players to earn crypto or NFTs, purchase in-game items with crypto, and trade in-game NFTs.

- Earning NFTs in Games: If tokens earned within a game can typically be traded and sold and have real-world value, these awards are taxed as ordinary income.

- Spending and Trading NFTs in Games: Whether you’re spending crypto to buy in-game items; purchasing in-game items with the game’s native tokens; or trading in-game tokens, these are all taxable transactions. Each transaction is considered a sale that creates a capital gain or loss.

NFT Taxes for Creators

In most situations, creating an NFT is not considered a taxable event. For NFT creators, the IRS identifies taxable events as any crypto transactions related to NFTs.

Business Tax Basics

There is a distinction between hobby and business income; we’d recommend speaking to a tax professional about your situation. For this guide, we’ll assume you have a business and can claim expenses.

Income and Expenses

- If you haven’t formally registered a business yet, then you either have a sole proprietorship (if it’s just you) or a general partnership (if you have one or more co-owners). In that case, you’ll report business income and expenses on Schedule C of your tax return.

- If you form an LLC and choose to be taxed as a sole proprietorship/general partnership, then again, your income and expenses are reported on Schedule C.

- If there are multiple owners of the business, you should also file a separate business tax return. Issue Form K-1 to each owner with information about share of the income and expenses.

Anything deemed an “ordinary and necessary” business expense can be included on Schedule C and deducted from taxable income.

Self-Employment Tax

Keep in mind that self-employment income is subject to FICA taxes. These fund Social Security and Medicare and are roughly 15% of your self-employment income.

Separate Business Accounts

It’s best to use a separate business bank account (or separate business wallet) and not mix your business and personal finances. Not only does this make your bookkeeping and taxes much easier, but it helps protect you from liability.

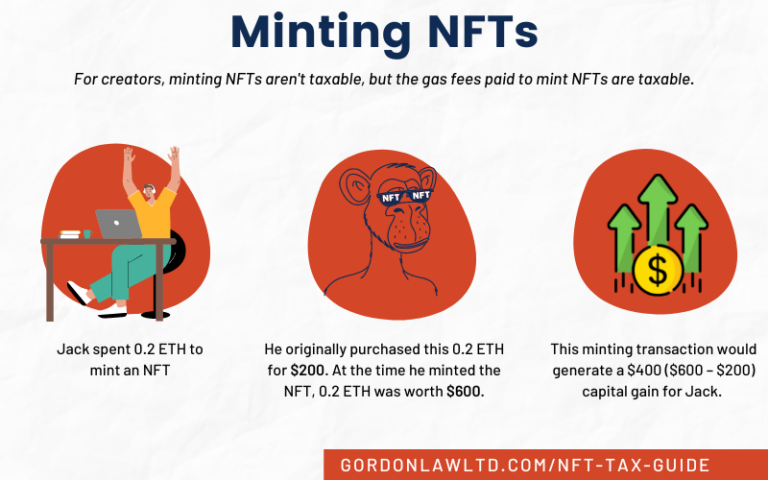

Minting NFTs

Although minting NFTs isn’t taxable, the gas fees paid to mint NFTs are taxable.

- For example, Jack spent 0.2 ETH to mint an NFT.

- He originally purchased this 0.2 ETH for $200. At the time he minted the NFT, 0.2 ETH was worth $600.

- Therefore, this minting transaction would generate a $400 ($600 – $200) capital gain for Jack. Jack’s cost basis on the NFT minted is $400.

- If Jack was a professional creator who frequently minted NFTs during his business, the $400 would be treated as ordinary income.

Selling NFTs

For creators, NFTs are taxed whenever they are sold for cryptocurrency or exchanged for another NFT.

- Suppose Jack only holds his NFT for 5 months and sells it for 5 ETH, now worth $15,000.

- Since he held the NFT for less than a year, Jack will incur a short-term capital gain of $14,600 ($15,000 – $400).

- If Jack would have had held the NFT for more than 1 year, his profit would be considered a normal capital gain (not short-term).

- If Jack was a professional creator, his $14,600 would have been reported as ordinary income and not capital gains.

- If you receive USD as payment for an NFT, simply record the dollar amount as miscellaneous income.

- If you receive cryptocurrency as payment, it’s a little more complicated. See our Cryptocurrency Tax Guide to learn how to report crypto income.

Are NFT Royalties Taxable?

For creators, recurring NFT royalties received for each sale are taxable.

- For example, let’s say Beeple releases a piece of artwork as an NFT, attached with 1% royalties in perpetuity. Following the original mint, Beeple receives 1% of each sale as his royalty.

- The income earned from NFT royalties is reported as ordinary income equivalent to the USD value of ETH at the time it was received.

Donating NFTs

Donating an NFT is not a taxable event. It can also allow you to offset your gross income if the following requirements are met:

- The NFT was held for more than 1 year

- The NFT was directly donated to an organization, without converting it to cryptocurrency or USD first

- The NFT was donated to a 501(c)(3) organization.

Making sure each criterion is met helps artists avoid owing capital gains tax on the proceeds of a charity auction, despite the proceeds being donations.

There are special rules regarding donating “art” that taxpayers should also be aware of. In order for artwork to receive the full market value deduction, it must meet the IRS related use rule. Whether NFTs fall under the category of “art” has yet to be determined.

NFT Taxes for High-Income Earners

High-income earners could face an additional tax on long-term capital gains for NFTs deemed “collectibles”.

Single filers who make over $459,750 and married filers making over $519,000 of annual taxable income fall into this category.

An NFT may be viewed as an investment or a collectible, depending on its nature.

The IRS defines the following capital assets as collectibles:

- Any stamp or coin

- Any antique or rug

- Any metal or gem

- Any work of art

- Any alcoholic beverage

- Any other tangible personal property that the IRS determines is a “collectible”

This affects the rate of taxation on capital gains. For investments, the long-term capital gains rate (for NFTs held more than 1 year) is 0%, 15%, or 20%.

For collectibles, the maximum long-term capital gains rate is 28%.

Not sure whether your NFT is a collectible or an investment? Contact our experienced cryptocurrency tax lawyers for more clarity given your specific situation.

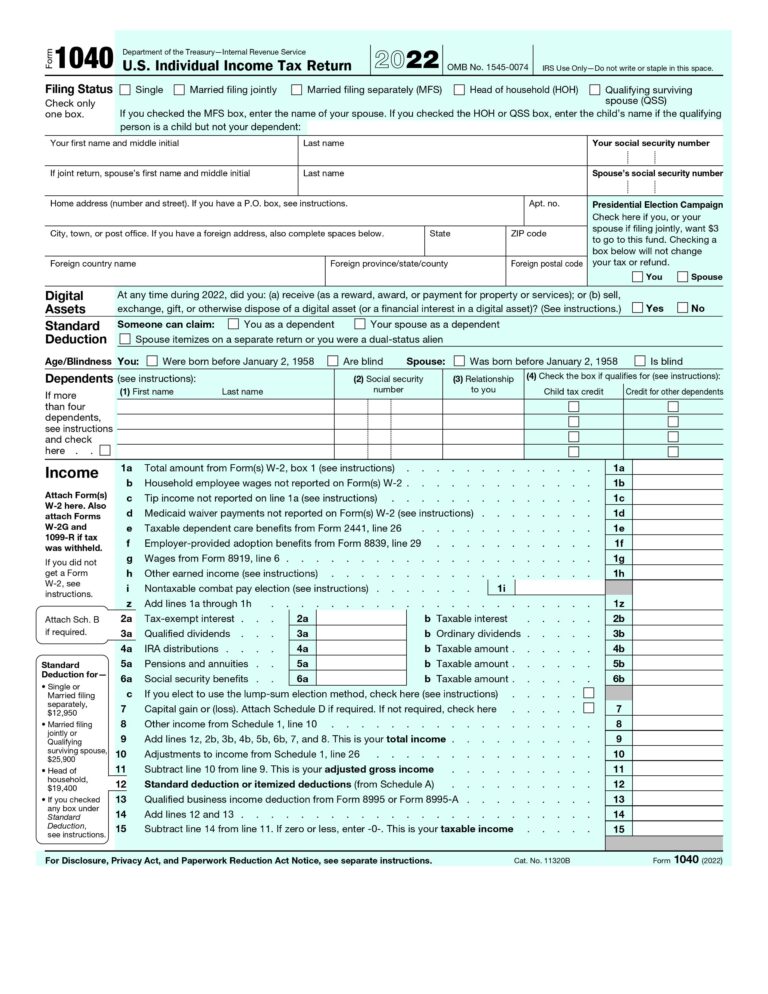

How to Report NFT Transactions on Your Taxes

It’s important to remember that NFTs are considered digital assets and should be reported on your annual tax return.

If you’ve done any of the above during the tax year, you’re required to check ‘Yes’ for the 1040 crypto tax question.

Checking “yes” is just the first step; you’ll also need to report crypto activity on your tax return.

NFT investors and creators can report their transactions using IRS Form 8949 and Schedule D to report capital gains/losses and NFT trading.

For professional creators, Schedule C can be used to report NFT-generated income and business expenses.

By now you should have a better understanding of how to navigate your NFT taxes!

If you need any additional help with crypto tax preparation, reach out to Gordon Law—we’d love to help!