For noncash charitable contributions to a 501(c)(3) organization, taxpayers often need clarification about the rules and regulations surrounding the deductions they can claim on their taxes. One area of confusion is the requirement for a qualified appraisal for cryptocurrency contributions.

In this post, we’ll explore the answers to two important questions recently addressed in an IRS Memo 202302012:

- Is a taxpayer required to obtain a qualified appraisal for contributions of cryptocurrency for which they claim a charitable contribution deduction of more than $5,000?

- If a taxpayer is required to obtain a qualified appraisal but fails to do so, can the reasonable cause exception apply if the taxpayer determines the value of the cryptocurrency based on the value reported by a cryptocurrency exchange?

Let’s dive into the details.

Charitable Deductions For Cryptocurrency

First, it’s important to note that under Section 170(f)(11)(C) of the I.R.C., a taxpayer must obtain a qualified appraisal for any charitable contribution of property for which the taxpayer claims a deduction of more than $5,000, including contributions of cryptocurrency.

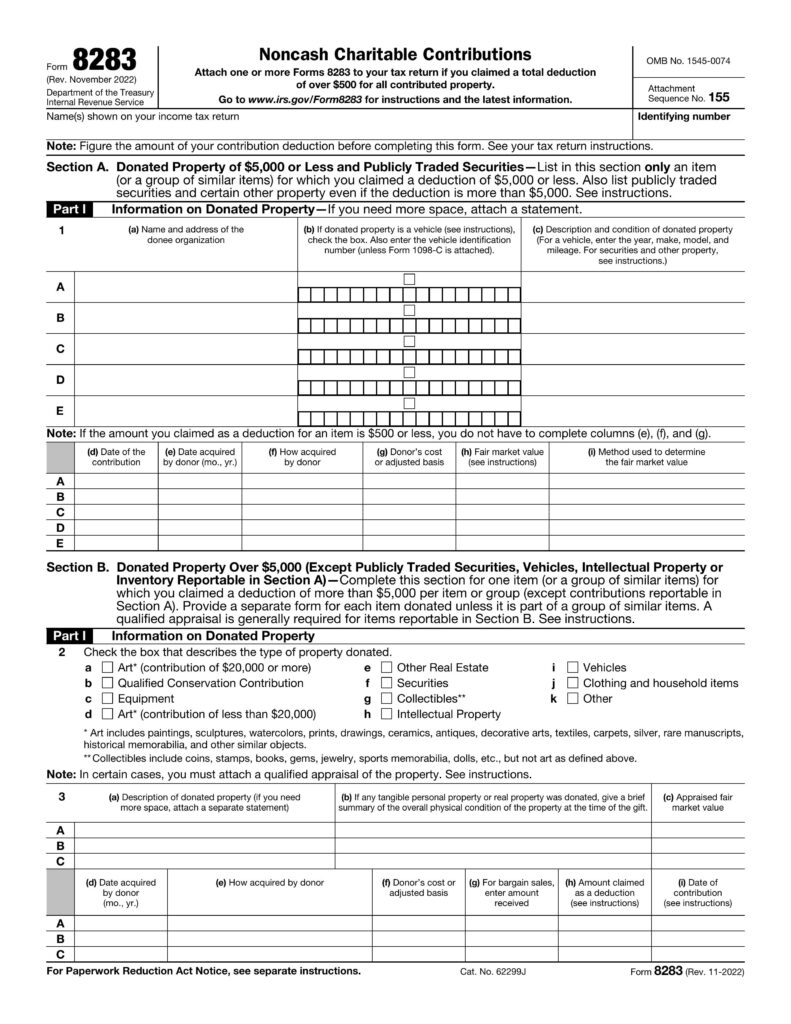

So, if a taxpayer claims a charitable contribution deduction of more than $5,000 for a contribution of cryptocurrency, they are required to obtain a qualified appraisal and file IRS Form 8238. Most times, when donating to a 501(c)(3), they will send you this form with an appraised value for the donation.

If you don’t have a qualified appraisal for the property you’re donating, you might still be able to claim a tax deduction. The important thing is that you show that there was a good reason for not having the report and that you made the donation in good faith.

What about determining the value of the cryptocurrency? If a taxpayer fails to obtain a qualified appraisal, can they still claim the deduction if they determine the value of the cryptocurrency based on the value reported by a cryptocurrency exchange?

The value reported by a cryptocurrency exchange is not a qualified appraisal. To claim the deduction, the taxpayer must obtain a qualified appraiser.

If you’re considering making a charitable contribution of cryptocurrency, you should consult a tax professional to understand the rules and regulations surrounding the deductions you can claim.

If you fail to do so, the reasonable cause exception may apply, but determining the value of the cryptocurrency based on the value reported by a cryptocurrency exchange will not.

Our experienced tax lawyers can help you better understand the deductions you qualify for.

What is IRS Form 8283?

IRS Form 8283, also known as the Noncash Charitable Contributions Form, is used to report noncash donations of property worth more than $5,000 to charitable organizations. These donations include:

- Clothing

- Household items

- Cryptocurrency & NFTs

- Artwork

- Real Estate

For donations worth more than $5,000, the form must be completed and attached to the donor’s tax return. It includes sections for the donor to provide information about the donation, such as a description of the property and its fair market value.

It also includes a section for the charitable organization to provide a statement of the organization’s use of the property and any restrictions placed on the use of the property. For noncash donations valued at more than $5,000, a qualified appraiser must complete the appraisal and attach it to the form.

It is also important to note that the IRS has specific rules regarding the deductibility of noncash donations.

For example, if the donor has used the property for more than one year, the deduction is generally limited to the property’s fair market value. However, the deduction may be more significant if the charitable organization has used the property in furtherance of its tax-exempt purpose.

Need Help With Donated Crypto?

In light of recent developments in the tax treatment of donated cryptocurrency, taxpayers need to understand the requirements for claiming a deduction.

If you’re thinking about donating your crypto, it’s important to know that you can claim a tax deduction. However, there are specific rules that you need to follow, like getting a special report called a “qualified appraisal.