Are you struggling with Illinois Department of Revenue collections? Do you have overwhelming Illinois tax debt that you can’t afford to pay? You have options, and our Chicago tax law firm can help!

We understand how stressful and overwhelming tax debt can be, but you don’t have to face this problem alone. Strategies are available to stop collections immediately. There are also ways to manage—even, in some cases, eliminate—your tax debt to the Illinois Department of Revenue (IDOR).

Let’s review IDOR’s collections strategies and how to halt these processes in their tracks.

Illinois Back Taxes: You’re Not Alone and You Have Options

You’re not the only one dealing with the weight of stressful tax debt. Fortunately, revenue agents understand financial roller coasters and are often willing to work out a compromise. The best course of action is to confront the issue head-on and seek the guidance of a skilled tax attorney who can secure the best possible resolution for your situation.

Remember: With the help of an experienced tax attorney, there’s a good chance you’ll be able to get your debt reduced, and in some cases eliminated. Schedule a free consultation with an attorney to discuss your options.

What Happens If You Don’t Pay Your Illinois Taxes? 4 Methods Used to Collect Tax Debt in Illinois

IDOR collections kick off when the agency believes you haven’t paid your full tax bill. This can include income tax, sales and use tax, and more. Businesses are often the target of IDOR’s collection activity, but individuals can face the wrath of the agency, as well.

- Before the state begins collections, they should notify you of your tax obligations in writing with instructions for what to do next. This is the best time to contact a tax attorney and nip the problem in the bud.

- If you ignore these notices, the Illinois Department of Revenue can use several methods to collect unpaid taxes, which we’ll explain below. These methods may seem extreme to the average taxpayer and can certainly throw a wrench in the middle of your life.

- We strongly recommend contacting an Illinois tax attorney before extreme collection measures begin. However, even if you’re in the midst of a lien, wage garnishment, or other tax debt issues, we can help!

Illinois Department of Revenue Liens

State and federal authorities can use liens to collect tax debts. What does that mean, exactly? Essentially, IDOR stakes a claim to some of your property, such as a house or car.

Once Illinois places a lien on your car, house, or other property, the state has the power to foreclose if the debt is not paid. Because of this, it’s very difficult to sell any property with a lien on it.

What’s more, liens are public information! IDOR’s Tax Lien Registry is a database accessible to the public that contains the names, addresses, and lien amounts of taxpayers who’ve had liens filed against them.

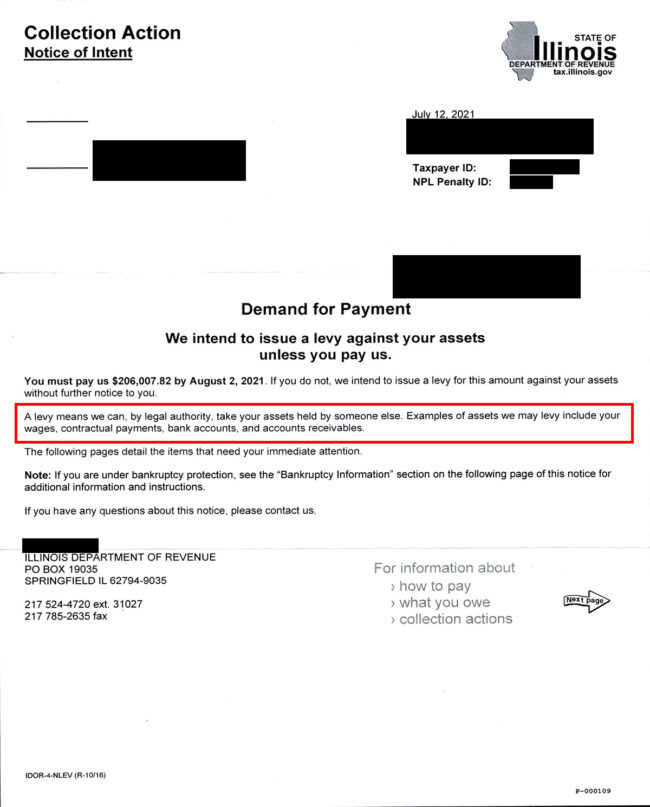

Illinois Department of Revenue Levies and Wage Garnishment

The Illinois Department of Revenue can also use levies (sometimes known as wage garnishment) to collect tax debts, which can be a real hassle. Levies can automatically deduct up to 15% of your paycheck—which, as you can imagine, is a very unwelcome surprise. Plus, it’s awkward for your employer to find out about your tax difficulties.

Alternatively, the Illinois Department of Revenue can place a bank account levy, seizing funds directly from your bank account and using them to pay off your tax debt.

It can be challenging to stop a levy once it’s already taken place. That’s why if you’re facing tax debt, it’s essential to seek the help of a tax attorney as soon as possible.

Here’s an example of a Notice of Intent to Levy from IDOR:

Asset Seizure by Illinois Department of Revenue Collections

Authorities can seize material assets (real estate, automobiles, equipment, jewelry, luxury items, etc.) to recover tax debt. You can stop this process, but you’ll need to act fast.

- IDOR typically notifies people 10 days ahead of confiscations.

- Seized items usually can’t be sold or auctioned by IDOR for at least 20 days after being commandeered.

- This gives you 30 days for a final opportunity to secure payment arrangements and halt seizures. Solutions can include negotiating loans or settlements.

If you’ve received notice of an impending asset seizure by the Illinois Department of Revenue, call our tax attorneys right away to find a solution.

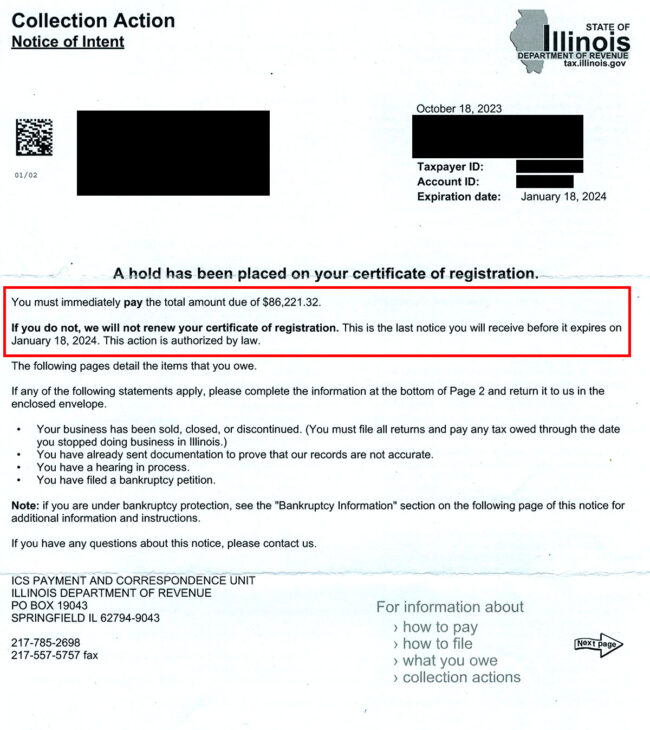

Professional Revocation by Illinois Department of Revenue Collections

It may seem counterproductive, but IDOR can revoke or suspend professional licenses, credentials, corporate charters, and lottery licenses as a result of unpaid tax debt. In some cases, they’ll include your name on a list of delinquent taxpayers which is posted online.

The state can be ruthless when it comes to tax debts, choosing to shut down a business instead of allowing the business to operate and pay back its dues. However, with the guidance of a skilled tax attorney, you can significantly improve your chances of negotiating a payment plan that enables you to keep your business running.

Here’s an example of a license renewal hold from the state of Illinois:

How Can I Stop Illinois Department of Revenue Collections?

Now that we’ve covered the worst-case scenarios, let’s get to the good news: You can overcome your tax debt. You have options! In this next step, we’ll explore how you can stop the collections process in its tracks.

Get ready to take charge and find a tax debt solution that works for you.

Stop Illinois Tax Debt Collections Fast with an Appeal

The first thing we can do to halt Illinois liens, levies, wage garnishment, and asset seizure is to file a petition with the Board of Appeals and request a Temporary Restraining Order (TRO).

While a TRO is not a get-out-debt-free card, it can stop IDOR’s collection activity within a matter of days. Here’s what you need to know:

- Once you file a petition, it often takes years for the Board of Appeals to hear your case. But that’s not necessarily a bad thing: In the meantime, the Illinois Department of Revenue cannot resume collection activities—as long as you’re following the terms of your TRO and making the correct payments.

- When requesting a TRO, you’ll have to include a financial statement. This will determine how much you have to pay monthly up until your hearing date.

- During the TRO period, you must continue to make these payments and file all tax returns on time; otherwise, collections will pick up right where they left off. (Plus, failing to file tax returns would add non-filing penalties to your existing debt.)

Want to see if you qualify for an immediate halt to Illinois tax collections? Give us a call today and schedule your free consultation!

Find a Long-Term Solution to Illinois Tax Debt

Once you have a Board of Appeals hearing set, your Illinois tax attorney can help you find a manageable, long-term solution for your tax debt. Options include:

- Installment Agreement: Pay off your debt over time (up to 6 years).

- Penalty Abatement: Reduce or eliminate certain penalties from your tax debt.

- Innocent Spouse Relief: Find relief from tax debt incurred by a former spouse.

- Offer in Compromise: Negotiate to pay back less tax than you owe.

Our experienced Chicago tax lawyers have helped hundreds of clients find a solution to their tax debt. We’ve saved our clients millions in taxes and penalties! We’ll help you understand all your options and guide you to a resolution that works for you.

Connect With A Chicago Tax Lawyer Today

Are you struggling with Illinois tax debt? Get your life back with the help of our experienced, skilled, and caring tax attorneys. We’ll negotiate with Illinois Department of Revenue collections on your behalf and provide crystal-clear guidance every step of the way. Most importantly, we’ll make sure you pay the least amount possible.

Don’t let tax debt take over your life. Take charge today and reach out for a free consultation.