FATCA Reporting: Filing Form 8938

Getting Rid of IRS Back Taxes

IRS Tax Penalties

IRS Adds Crypto to Voluntary Disclosure Program

What Triggers an IRS Audit?

How Far Back Can the IRS Audit You?

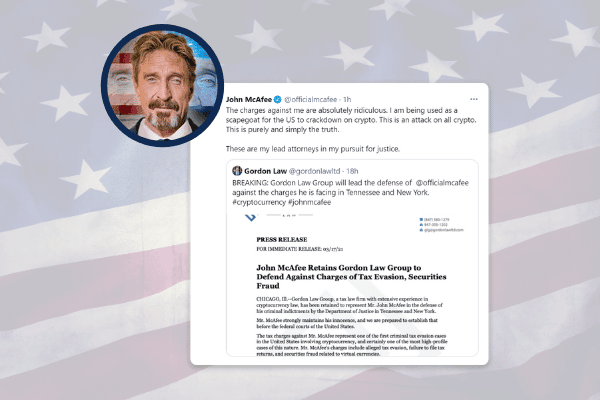

John McAfee Retains Gordon Law Group to Defend Against Charges of Tax Evasion, Securities Fraud

Did You Receive IRS Letter 6174, 6174-A, or 6173?

If you received an IRS crypto warning letter, you should call us sooner rather than later.