Offshore accounts were once the go-to option for Americans who wanted to hide money from Uncle Sam. Those days are long gone due to the Foreign Account Tax Compliance Act (FATCA).Since being signed into law, FATCA reporting has aided the IRS’s fight against tax evaders concealing assets in foreign countries.

By the end of this article, you’ll have a better understanding of FATCA filing requirements and the penalties that can pile up if you fail to file.

What Is FATCA?

The Foreign Account Tax Compliance Act (FATCA) was developed in 2010 to ensure US taxpayers actively report (and pay tax on) their foreign assets, accounts, and investments.

The IRS has aggressively pursued foreign account compliance by US citizens worldwide by entering intergovernmental agreements (IGAs) with 300,000 foreign financial institutions in 113 countries.

The deal requires all foreign financial institutions to identify and report information regarding US accounts.

The US depends heavily on cooperation from other countries to prevent billions of dollars from being unreported each year.

If you have foreign accounts, your foreign financial institution may require you to fill out a W-9 form to comply with FATCA reporting.

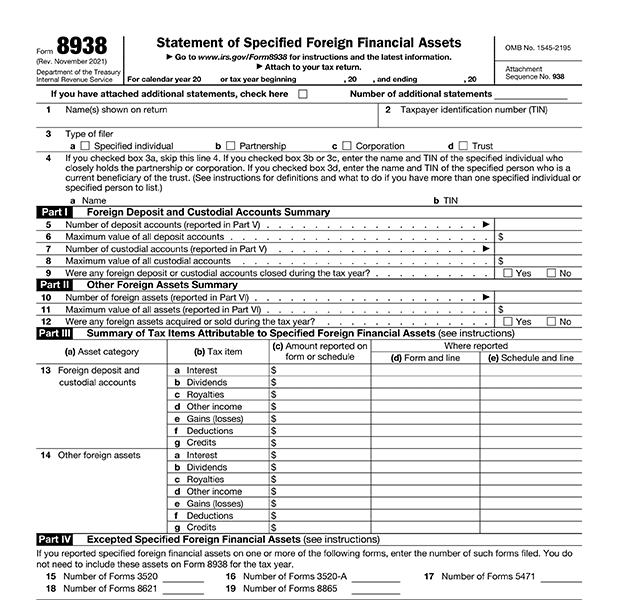

What Is Form 8938?

Form 8938 (Statement of Specified Foreign Financial Assets) is the form used to report qualifying foreign assets to the IRS. The form officially became a part of the income tax return in 2011.

FATCA vs. FBAR

Foreign Bank Account Reporting (FBAR) is another reporting form that helps the IRS prevent US citizens with foreign assets from slipping through the cracks during tax time.

Although the FBAR and Form 8938 are both focused on foreign investments, several differences separate the two:

- The FBAR is collected by the Financial Crimes Enforcement Network (FinCEN), while Form 8938 is reported to the IRS

- The FBAR focuses on foreign bank accounts, while Form 8938 focuses on all foreign assets

- The reporting thresholds for Form 8938 are much higher than the FBAR reporting threshold

- Form 8938 and the FBAR are both due by the April 15 tax deadline, but have different rules for extension

- The FBAR deadline automatically extends to October 15 if not filed by the original deadline

- The deadline for Form 8938 can only be extended by request

You may be required to file only one of the forms or both, depending on the types of assets you have and their value. If you aren’t sure, we recommend consulting a professional FBAR attorney to help!

FATCA Reporting Requirements

Who needs to file Form 8938? FATCA reporting requires US taxpayers and foreign financial institutions to disclose specified foreign assets held in foreign accounts.

The IRS defines specified foreign assets as:

- Foreign partnerships

- Foreign pensions

- Foreign mutual funds

- Foreign hedge funds

- Foreign stockholdings

- Foreign real estate held through a foreign entity

If you filed Form 3520 or reported foreign entities or gifts on another form, you can simply list the submitted forms on Form 8938. You may also be exempt from FATCA reporting if you were not required to file an income tax return for the year.

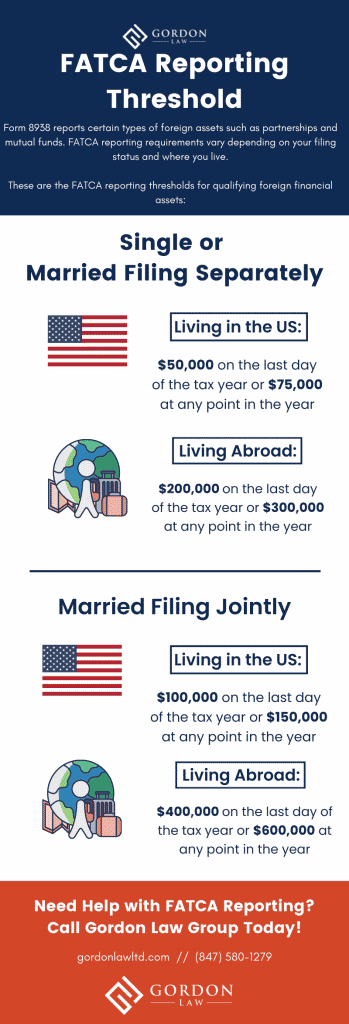

FATCA Reporting Threshold

The FATCA reporting threshold varies depending on where you live and your current filing status.

These are the FATCA reporting thresholds for qualifying foreign financial assets:

Single Taxpayers or Married Filing Separately

- Living In the US: $50,000 on the last day of the tax year or $75,000 at any point in the year

- Living Abroad: $200,000 on the last day of the tax year or $300,000 at any point in the year

Married Taxpayers Filing Jointly

- Living In the US: $100,000 on the last day of the tax year or $150,000 at any point in the year

- Living Abroad: $400,000 on the last day of the tax year or $600,000 at any point in the year

If the value of your foreign accounts doesn’t exceed the values mentioned above, you are not required to file Form 8938.

FATCA Penalties

If you are required to submit Form 8938 but fail to do so, you may be subject to FATCA penalties. The penalties for US citizens living abroad are much higher than those with foreign accounts currently residing in the US.

Form 8938 must be submitted to the IRS by the tax deadline, or the extended deadline if you file a tax extension. Failure to file by the deadline will result in a $10,000 penalty.

If the IRS has still not received your submission 90 days after the deadline, you may be subject to an additional $10,000 penalty every 30 days you continue to fail to file. The maximum additional penalty for failure to file Form 8938 is $50,000.

Need Help with FATCA Reporting?

While the IRS continues to keep foreign accounts held by US citizens under a microscope, FATCA reporting can be confusing.

If you aren’t sure how to get the FATCA reporting process started, our experienced team of attorneys can help!

Avoid potential IRS penalties and a mountain of tax debt by contacting Gordon Law Group today!