So, you’ve done your research on how cryptocurrency taxes work and you’re ready to start your crypto tax preparation. You know that capital gains will need to be reported on your return. Now you’re probably wondering, “How do I calculate my crypto cost basis?”

The bad news? The solution is rarely simple. But with a decade of crypto tax experience, our accountants are here to unravel this common question! In this guide, we’ll walk you through:

- How to calculate cost basis for cryptocurrency

- Various cost basis methods

- And some common scenarios that can trip up even experienced investors.

Ready to master your crypto taxes? Let’s dive in.

What Is Cost Basis for Crypto?

Cost basis is the original purchase price of a crypto asset for tax purposes. When you sell, trade, or dispose of your crypto, it triggers a capital gain or loss. Knowing the cost basis of your crypto is an essential piece of information for calculating gains and reporting cryptocurrency on your tax return.

Cost Basis vs Proceeds

Cost basis is the initial investment amount, while proceeds are the amount you receive upon selling or trading an asset. The difference between the 2 is your taxable gain or loss.

How Do You Calculate Crypto Cost Basis?

At first glance, the formula for crypto cost basis is simple: Total Purchase Price divided by Number of Tokens. For example, let’s say you paid $500 for 10 AAVE tokens. $500 / 10 = a cost basis of $50 per token.

However, cryptocurrency operates in a complex ecosystem, and buying crypto with fiat is only the tip of the iceberg.

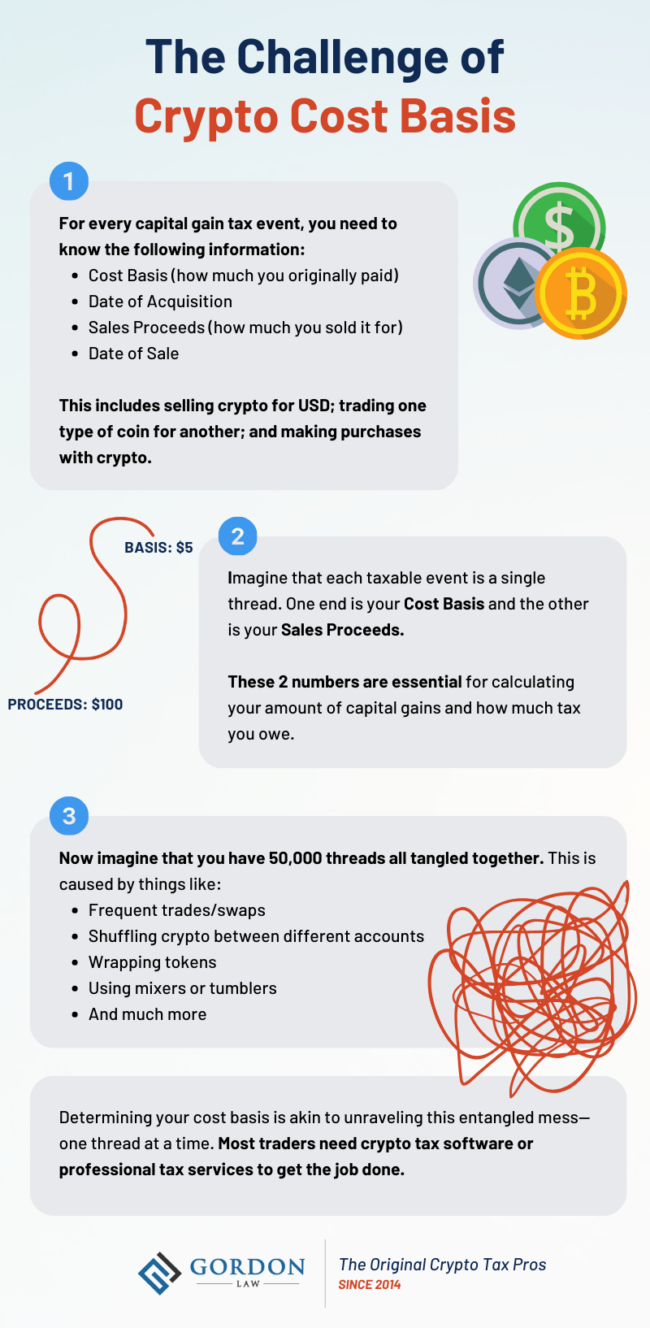

The Challenge for Cryptocurrency

Imagine that each sale or trade of cryptocurrency is a thread. One end represents the cost basis while the other represents proceeds.

Now imagine that you have 50,000 threads representing all your trades throughout the year. As you engaged in multiple transactions, moving crypto across accounts or diving deep into DeFi, these threads transformed into a formidable tangle.

Determining your cost basis is akin to unraveling this entangled mess—one thread at a time.

How to Do It

So, how do you calculate crypto cost basis for all of your trades?

- Start by downloading your complete transaction history from each wallet or exchange you used during the tax year.

- All this information must be combined into a single data set. Every buy, sell, trade, deposit, and transfer between accounts should be included.

- Next, you essentially need to trace the history of each token. You’ll need to find the following information for each taxable event:

- Cost Basis

- Acquisition Date

- Sales Proceeds

- Date of Sale

Cryptocurrency tax software is designed to automate this daunting task. It’s not foolproof (see our post on the top 5 common issues), but it can be an extremely useful tool.

Do you want an even easier solution without any guesswork? Consider hiring a crypto accountant to generate a meticulously accurate tax report for you.

Crypto Cost Basis Methods

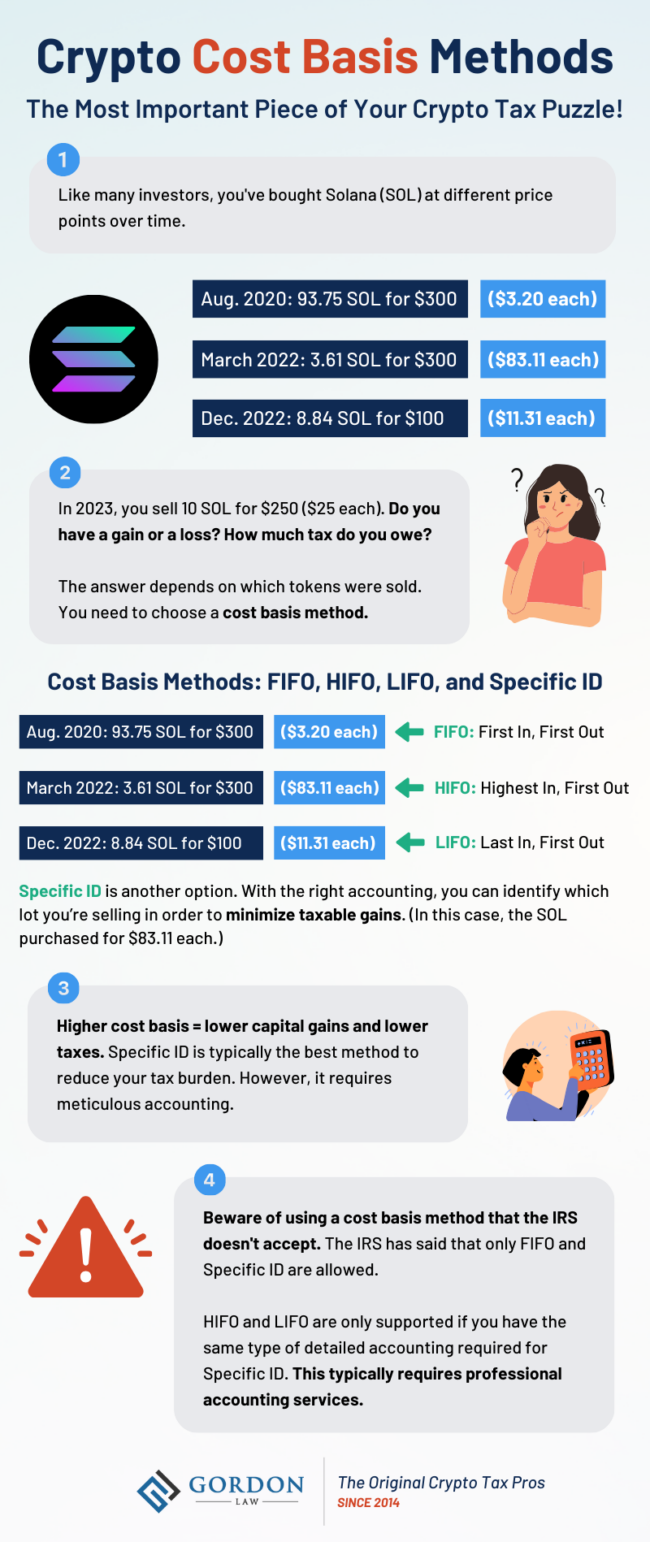

To make the process of finding your crypto cost basis even more fun, there are several cost basis methods to choose from. Since this will impact your overall tax bill, it’s vital to choose the method that’s best suited for your situation:

- FIFO (First-In, First-Out): This method assumes that the first cryptocurrency you bought is also the first one you sold.

- Specific ID: Through meticulous accounting, you can specifically identify the buying price of each token sold. This method can help lower your overall capital gains, thereby lowering your tax bill.

- LIFO (Last-In, First-Out): This method assumes the most recent crypto you bought is the first one sold. This method is typically not supported by the IRS.

- HIFO (Highest-In, First-Out): This method assumes that the coins with the highest cost basis were sold first. Many investors choose HIFO because it lowers their tax burden, but they don’t realize that the IRS may not accept their calculations.

- Average Cost Basis: Since cost basis calculation is so difficult for crypto, many investors simply use an average value. For example, if Bitcoin peaked at $60,000 and bottomed out at $30,000, they would say that the average value of 1 BTC is $45,000. But beware! This method is not allowed by the IRS.

Pro Tip: FIFO and Specific ID are the only crypto cost basis methods supported by the IRS. A cost basis calculator may let you choose LIFO or HIFO instead, but this might cause trouble if you ever become the target of a crypto tax audit.

In practice, LIFO and HIFO are not possible for cryptocurrency without extremely detailed Specific ID. This is stated in the IRS FAQ on Virtual Currency Transactions: “If you do not identify specific units of virtual currency, the units are deemed to have been sold, exchanged, or otherwise disposed of in chronological order beginning with the earliest unit of the virtual currency you purchased or acquired; that is, on a first in, first out (FIFO) basis.”

All 3 methods require the same level of detailed accounting, which is typically not possible with software alone. It takes many proactive steps by the trader to meet these requirements, including physically separating the crypto through different wallets for different tax lots.

Have questions about your cost basis method? Reach out to our skilled crypto tax attorneys today!

What Is the Best Cost Basis for Crypto?

The “best” cost basis method for crypto depends on your circumstances and tax goals. Some methods may minimize your tax liability in the short term, while others might be more beneficial in the long run. Beware of using a method that the IRS doesn’t allow, and consider speaking with a tax professional for advice.

Adding Fees to Cost Basis

Fees associated with buying crypto should be added to the cost basis. This includes gas fees. Some cryptocurrency tax calculators do this for you automatically.

How Do You Calculate Missing Cost Basis for Crypto?

There are several reasons why you may not know your cost basis for crypto—whether you received the crypto as a gift, the number is missing on Form 1099-B, the exchange you purchased from is now defunct, or many other possible reasons.

To fix this, start by gathering as much data as possible from exchanges, wallets, and other sources.

- If you’re missing the cost basis for a capital gain taxable event (including a sale, swap, or purchase made with crypto), see the section above for calculating crypto cost basis.

- If you’re missing the cost basis for a gift, airdrop, or other type of deposit, learn more here.

Still have questions or need advice tailored to your unique situation? Don’t hesitate to reach out! Our experienced accountants and crypto tax attorneys are here to help you file with complete confidence.

How Does the IRS Verify Cost Basis for Crypto?

When the IRS audits a cryptocurrency tax return, an examiner will typically rebuild the entire return from scratch. The only cost basis methods supported by the IRS are FIFO and Specific ID—so if you used a method like HIFO without proper documentation, you may owe additional tax. On top of that, the IRS can charge a 20% accuracy-related penalty, non-payment penalties, and interest.

Audit examiners will typically do what’s best for the IRS, not what’s best for your wallet. It’s the taxpayer’s burden to prove the cost basis of an asset. That means you need meticulous documentation of your transactions, or else the IRS can slap you with a huge tax bill. It’s wise to save all tax documents, including full transaction histories, for 6 years.

Common Issues with Crypto Tax Audits

Let’s look at some examples of issues that frequently arise in cryptocurrency tax audits.

Bitcoin ATM Purchases

Sarah has purchased crypto from Bitcoin ATMs several times throughout the years. Purchasing crypto with fiat is not a taxable transaction. However, during an IRS audit, Sarah can’t find her Bitcoin ATM receipts—she never thought it would be important to hold onto them.

Without proper records, the IRS only sees deposits of BTC into Sarah’s wallet. Each deposit will be treated as ordinary income, with a tax rate of 10-37%.

Self-Transfers

Like most crypto traders, Devan frequently transfers his crypto between different accounts. In one transaction, he moved 5 ETH from his Coinbase account to his FTX account. A few years later, Devan receives notice of an IRS audit—but FTX is now defunct and Devan has no way to get his old transaction records from the exchange.

The IRS sees that 5 ETH was moved out of Devan’s Coinbase account. Without the records from FTX, there’s no proof that this was a non-taxable self-transfer. The IRS will treat this transaction as a sale of 5 ETH, triggering capital gains tax.

Pro Tip: Back up your complete transaction history from each of your exchanges and wallets on a regular basis (at least once per year) in case the information is lost in the future.

Can I Set My Cost Basis to Zero?

Setting your crypto cost basis to zero is typically not allowed. That being said, it can be truly difficult to find your cost basis in some instances—for example, if you received an airdrop of an uncommon token.

There are some rare occasions where you may be able to set cost basis to zero, but you should consult with a qualified tax professional to make sure.

Cost Basis for Common Transactions

What Is the Cost Basis of an Airdrop?

The cost basis for a crypto airdrop is typically the fair market value of the token at the time it’s received.

It’s relatively easy to find this information if you receive an airdrop of a frequently traded token like $BANANA. But what if you receive an NFT that’s never been traded before? What if you receive a random meme coin that your friend created as a joke?

These things occur often in the world of crypto, but the answers are never simple. In fact, there are so many “what ifs” that it’s impossible to give a straight answer over the internet. If you find yourself in this situation, consult a professional for tax advice.

What Is the Cost Basis on Crypto-To-Crypto Swaps?

When you convert one cryptocurrency to another, there are actually 2 transactions occurring in the eyes of the IRS: a sale of the first token and a purchase of the second token.

First, determine the proceeds of the “sale”—what was the price of that token at the time you disposed of it, and how much did you sell? This amount becomes the cost basis of the second token.

What Is the Cost Basis of Forked Cryptocurrency?

If you earn additional cryptocurrency as the result of a hard fork, the new crypto is considered ordinary income at the time of receipt. The cost basis is the fair market value of that crypto at the time of receipt.

Soft forks are not taxable and there is no change in the coins taxability. What Is the Cost Basis of Inherited Virtual Currency?

What Is the Cost Basis of Inherited Virtual Currency?

For inherited cryptocurrency or other digital assets, the cost basis is usually the fair market value on the date of the benefactor’s death.

What Is the Cost Basis of Cryptocurrency Received as a Gift?

When you receive cryptocurrency as a gift, you inherit the giver’s cost basis and acquisition date. We advise the giver to send this information to the recipient in a gift letter.

What Is the Cost Basis of Mining Rewards?

The basis for mined crypto is the fair market value at the time the assets were awarded. Learn more about cryptocurrency mining taxes.

What Is the Cost Basis of Staking Rewards?

The cost basis for staking rewards is the fair market value of the asset at the time of each deposit. If your staking rewards are locked up for a set period of time, then the rewards are only taxable when they become unlocked. Learn more about how staking rewards are taxed.

What Is the Cost Basis of Rebranded Cryptocurrency?

In some cases, a cryptocurrency may be rebranded and your old tokens can be swapped out for new ones. If the new crypto replaces the old, then this is not taxable. Your cost basis for the new tokens is based on the initial purchase price.

For example, let’s say you bought 100 Xcoin for $1,000. The cost basis for each Xcoin is $10 ($1,000 / 100 = $10).

Then, Xcoin rebrands to XYcoin and increases volume 10:1. You trade in 100 Xcoin for 1,000 XYcoin. You now have more tokens, but you still only spent $1,000 initially. The cost basis for the new XYcoins is $1 each ($1,000 / 1,000 = $1).

Need Easy and Accurate Calculations? We Can Help!

Calculating your crypto cost basis is much more challenging than most investors realize. Even using specialized software, you might have to spend several hours fixing the data and trying to find the right numbers.

Want to eliminate this guesswork and make your crypto taxes as easy as possible? Call Gordon Law Group! Since 2014, we’ve helped more than 1,000 investors file easily and accurately. With experienced crypto accountants and crypto tax lawyers on your side, you can feel confident that your numbers are correct.

Reach out today if you want to save time, save money, and enjoy peace of mind!