As you delve into the world of crypto mining, you can uncover incredible opportunities. But there’s a catch: the looming presence of crypto mining tax. The landscape is filled with potential pitfalls, but with the right guide, you can safely navigate IRS rules and protect your digital treasures.

With a decade of experience, the crypto tax accountants at Gordon Law Group are here to light the way. In this guide, we’ll make crypto mining taxation crystal clear and help you unearth powerful money-saving strategies.

How is Crypto Mining Taxed?

The IRS views Bitcoin mining or cryptocurrency mining as a taxable activity. Each time you receive a mining reward, you have taxable income to report. To calculate the amount of income in USD, you’ll have to find the coin’s fair market value at the time it was mined. Multiply this amount by the amount of coins you received.

Later, if you sell or dispose of the tokens, you’ll have a capital gain or capital loss, depending on whether you made a profit. The cost basis for mined crypto is the fair market value at time it was mined.

Is Income from Bitcoin Mining Double Taxed?

It’s a common misconception that income from Bitcoin mining is double taxed. This is because you pay income tax on the original mined crypto and capital gains tax on any profits from selling it. However, your mining income will only be taxed once. Let’s look at an example:

- Meet Emily, an avid Bitcoin miner. One day, she successfully mines 1 Bitcoin, which is worth $50,000 at the time. This $50,000 is taxable as ordinary income.

- Fast forward 6 months: Emily decides to sell that Bitcoin, which is now worth $60,000. This sale generates a capital gain of $10,000 ($60,000 sale price minus the original $50,000 value).

- So, while Emily pays income tax on the initial $50,000, she only pays capital gains tax on the $10,000 profit she made from selling the Bitcoin.

This isn’t double taxation on the same income, but rather 2 different types of income events.

Common Issues with Bitcoin Mining Taxes

Mining Bitcoin or any other cryptocurrency can create tax headaches because the crypto market is so unpredictable. This is especially true for new miners who haven’t planned ahead for their crypto mining tax. Our accountants frequently encounter these 2 scenarios:

Scenario 1: High Value When Mined, Low Value During Tax Time

John mined 1 Bitcoin when it was valued at a peak of $65,000. However, by the time he prepares his tax return several months later, the value of Bitcoin has plummeted to $32,000.

Despite the drop in value, John’s taxable income is still based on that initial $65,000. Now, John faces a dilemma. He has a high tax bill based on the higher value, but he doesn’t have the money to pay it.

Scenario 2: Low Value When Mined, High Value at Tax Time

Lisa, on the other hand, started her mining journey when Bitcoin was valued at a modest $30,000. As the year progressed, the value of Bitcoin surged. By the time Lisa is ready to file her taxes, her Bitcoin is worth a staggering $55,000.

In theory, Lisa has plenty of money to pay her tax bill—but it’s all tied up in crypto, not fiat. She could sell some of her BTC to cover the bill, but that would trigger a capital gain based on the increased value.

If she sells her Bitcoin for $55,000, she will not only owe taxes on the original $30,000 of mining income, but also on the $25,000 capital gain from the sale.

Can I Use Crypto Mining Tax Deductions?

Yes, the IRS typically classifies crypto mining as a business activity, which means you can deduct business expenses. Here are some common deductions for those mining Bitcoin or other cryptocurrencies:

- Mining Pool Fees: Most of our clients who mine crypto do so through a mining pool. The associated fees can be tax deductible.

- Electricity Costs: Electricity is typically the highest expense for miners, and these costs can be deducted from taxable income.

- Mining Equipment: Those investing in their own mining equipment can write off the expense yearly by depreciating the asset. This means a portion of the initial cost is deductible each year.

- Rented Space: If you lease a space specifically for mining operations, you can write off that cost.

- Home Office Deduction: Do you use a home office for mining operations? If you use the space exclusively for business purposes, then you can use the home office deduction to write off a portion of rent or mortgage payments, electricity costs, and even home repairs.

Should I Form an LLC to Save on Crypto Mining Taxes?

Forming an LLC can be beneficial to cryptocurrency miners, but it typically won’t save you any money on taxes. If you make over $100,000 per year from crypto mining, you might consider forming an LLC and using an S-corp election to save on taxes.

In most cases, though, the benefits of an LLC for crypto miners are focused on privacy and asset protection rather than tax savings.

Consider Forming a C-corp

If you have significant mining revenue and you don’t expect to convert your Bitcoin to fiat in the next few years, it may be beneficial to form a C-corp.

Corporations are taxed at 21%, which may be lower than your personal income tax rate. However, C-corp income is double taxed on distribution. Please consult with a tax professional to discuss your options.

What Is the 30% Tax on Crypto Mining?

The Digital Asset Mining Energy (DAME) tax was a proposed excise tax that was included in President Biden’s 2024 federal budget proposal. This tax on cryptocurrency miners would amount to up to 30% of miners’ electricity costs.

In May 2023, the DAME tax was eliminated from the bill in which it was initially proposed. The issue could arise again in future bills, but for now, there is no 30% tax on crypto miners’ electricity costs.

How to Avoid Taxes on Crypto Mining

It’s great to earn extra income from cryptocurrency mining, but you know what’s not so fun? The tax bill waiting at the end of the year. You may not be able to avoid crypto mining taxes entirely, but you can certainly make some clever moves to keep more coins in your wallet instead of sending them to Uncle Sam.

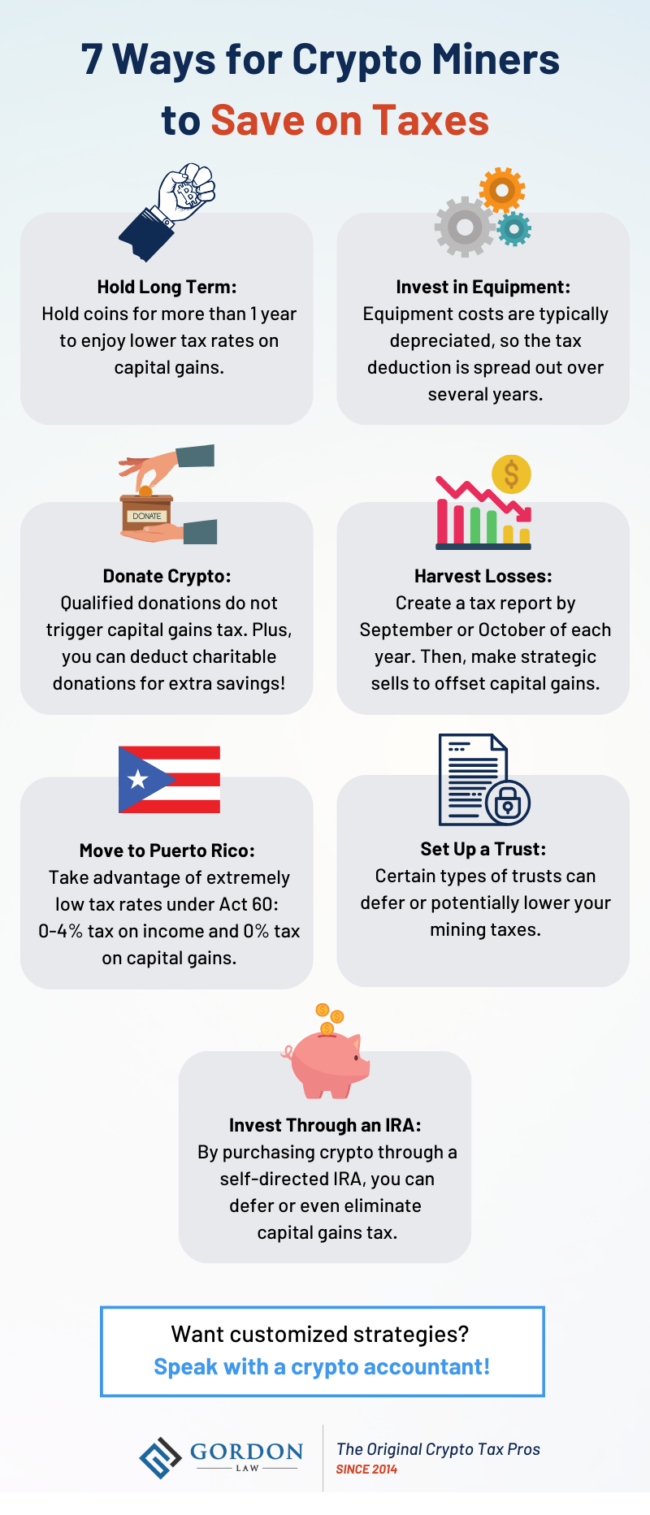

Popular strategies to reduce or avoid crypto mining tax include holding coins long-term, making charitable donations, and contributing Bitcoin to retirement accounts.

It’s important to consult a crypto tax professional for advice regarding your specific situation, but let’s dive into some of these tax-saving tactics:

1. Hold Coins for More Than 1 Year

If you hold onto your mined coins for more than 1 year before selling them, you’ll incur long-term capital gains instead of short-term gains. Typically, long-term capital gains tax rates are lower, so this strategy can result in a smaller tax bill when you eventually sell your coins.

2. Continue Re-Investing in Equipment

Continually upgrading your mining equipment has 2 benefits: it keeps your mining operation competitive, ensuring better yields, and it allows for continual tax deductions.

Equipment costs are depreciated (a portion of the initial cost is deducted from taxable income each year), so the money you spend on new equipment can provide tax write-offs for years to come.

3. Donate Appreciated Crypto

If you’re holding onto cryptocurrency that’s gained value since you originally mined it, consider donating the coins to a qualified charity. This lets you avoid capital gains tax, and it counts as a tax deduction.

4. Use Losses to Offset Taxable Gains

The volatile nature of cryptocurrencies means that sometimes, the value of your holdings might decrease. If you sell crypto at a loss, you can use that loss to offset other taxable gains, effectively reducing your tax burden. This strategy, commonly known as tax loss harvesting, can be particularly useful in years where the crypto market faces downturns.

5. Move to Puerto Rico

Puerto Rico, a U.S. territory, offers some unique tax incentives for crypto miners and traders. Under Puerto Rico Act 60, you can enjoy 0-4% tax on mining income and 0% tax on capital gains. Because of this, relocating to Puerto Rico has become a very popular way to avoid taxes on cryptocurrency.

Before packing your bags, be sure to research and understand the residency requirements and other obligations. Our experienced cryptocurrency tax attorneys can help with this process, so reach out if you have any questions.

6. Consider Using a Trust

You may be able to defer or minimize taxes by setting up a trust for your crypto mining operations. If your goal is to build a nest egg rather than spending your mining income right away, you might consider using a trust. However, setting up and managing a trust can be complex, so it’s crucial to speak with a professional.

7. Buy Bitcoin from an IRA

You can avoid capital gains tax and plan for retirement by purchasing Bitcoin through an Independent Retirement Account (IRA). You can trade within the IRA with no capital gains tax. Additionally, if you use a Roth IRA, qualified distributions are tax-free.

How to Report Crypto Mining Taxes

To ensure compliance with the IRS when reporting your crypto mining taxes, follow these steps:

- Gather All Transaction Records: Compile a comprehensive record of all your transactions, including mining rewards and any trades. If you receive any 1099 forms from a mining pool or a cryptocurrency exchange, be sure to save these records as well.

- Calculate Ordinary Income: The value of the coins at the time they were received is ordinary income.

- List Deductible Expenses: Identify and list all mining-related expenses you’ve incurred, from electricity to equipment costs. Be sure to save receipts.

- Fill Out IRS Form 1040: Report your mining income and expenses on Schedule C of IRS Form 1040.

- Report Capital Gains or Losses: If you’ve sold any of your mined cryptocurrencies during the tax year, report the capital gains or losses on Form 8949.

- Pay Any Owed Taxes: After calculating your total tax liability, pay any taxes owed before the deadline to avoid IRS penalties.

Pro Tip: For most of our clients, mining is only one facet of a more complex cryptocurrency portfolio. Reporting crypto taxes can feel like a dark and daunting maze, but Gordon Law Group is here to guide you through safely.

Our experienced crypto tax lawyers and accountants have helped more than 1,000 investors file accurately and uncover hidden savings. Plus, we offer a whole trove of essential crypto business services, including business formation, contract review, crypto bookkeeping, and more.

If you need help making your mining taxes crystal clear, don’t hesitate to reach out!