The world of Decentralized Finance, or DeFi, has exploded recently, offering new and innovative financial services through blockchain technology.

As this sector continues to grow, it has raised some of the most complex tax questions, and the IRS is still working to provide clear guidance on these scenarios.

Despite the lack of specific guidance, it is crucial to understand the tax implications of DeFi activities, as failure to comply with tax laws can result in significant penalties and fines.

This article will explore some common DeFi scenarios and their tax implications to help you stay informed and comply with the IRS.

Table of Contents

What is DeFi?

Decentralized Finance (DeFi) refers to financial services built on blockchain technology designed to be open and accessible to everyone.

DeFi services are run by a decentralized network, meaning no single entity controls them. Instead, they operate on a computer network not controlled by any central authority.

This makes DeFi services more secure, transparent, and accessible than traditional financial services.

DeFi applications are in the Ethereum ecosystem and chains like Solana and Avalanche.

Automated Market Making (AMM) and Liquidity Pools are unique technological advancements, enabling the “decentralized” capabilities of many of the popular DeFi platforms today.

Do DeFi Exchanges Report to the IRS?

Currently, they don’t, but you still need to report your decentralized crypto activity and pay tax on your income.

Believe it or not, the IRS can track down your accounts on decentralized exchanges!

Additionally, the Infrastructure and Investment Jobs Act will require all exchanges to issue tax forms starting in 2024.

Tax Implications of DeFi Activities

Before we get started, it’s important to know that two types of tax typically apply to DeFi transactions: capital gains tax and ordinary income tax.

If you need a refresher on how those work, check out our Crypto Tax Guide!

Let’s dive into some everyday DeFi activities and their tax implications.

Remember the IRS has yet to issue specific guidance on most of these scenarios, so our cryptocurrency tax lawyers rely on the limited guidance available. Many transactions need to be reviewed on a case-by-case basis.

If you want to avoid trouble with the IRS, it’s best to use an experienced tax professional who understands cryptocurrency and decentralized finance.

Gordon Law Group has focused on crypto taxes since 2014 and has seen it all!

Do You Have to Pay Taxes on Crypto Loans?

Decentralized finance allows ordinary people to loan each other money without going through a bank. The borrower repays the loan with interest, just like a traditional loan.

Loans are not taxable income, and paying off a loan is not a deductible business expense.

However, keeping track of your crypto activity, including the movement of coins, cost basis, and acquisition date, is important.

Additionally, paying interest with cryptocurrency can result in a capital gain or loss. If you need to convert crypto to pay back a loan, that conversion will result in a capital gain or loss.

Taxes for the Borrower

You don’t have to pay taxes on your cryptocurrency as income as a borrower.

However, if you use cryptocurrency to make loan payments, it will be considered a taxable event, resulting in a capital gain or loss you’ll need to report.

Additionally, it’s important to note that paying off a loan using cryptocurrency cannot be deducted as a business expense.

The deductibility of the expense depends on how you apply the loan proceeds. There are 3 main applications here:

- If you use them to purchase investments like bonds or bonds, you can deduct the interest to the extent of net investment income. And in future tax years, you must offset any excess against net investment income.

- The interest isn’t deductible if you used the proceeds to produce tax-exempt income.

- Lastly, if you use them in business or trade, you can deduct 30% of earnings before interest, taxes, depreciation, and amortization.

In case of a foreclosure, the IRS will treat it as a sale for tax purposes. The gain or loss is ordinary if you use it for trade or business.

Taxes for the Lender

If you lend money in cryptocurrency, you will have to pay taxes like any other type of loan. The amount of taxes you will pay depends on the laws in your country and the terms of your loan agreement.

When your loan is paid back, you may make or lose money when you convert the cryptocurrency into your fiat currency or a different type of cryptocurrency.

The amount of taxes you pay for this profit or loss will depend on your specific situation and the laws in your country.

Talking to a tax lawyer to understand your tax responsibilities when lending in cryptocurrency is important.

Lenders should also consider the tax implications of any capital gains they may realize if they sell the cryptocurrency they receive as collateral.

The tax treatment of such gains would depend on the specific circumstances of each case.

What Are the DeFi Tax Implications on Liquidation?

When it comes to taxes, it’s important to understand that liquidation is typically associated with borrowing rather than liquidity pools.

Here’s a typical scenario: Sara provides 10 ETH, which is not a taxable event, and then borrows $5,000, resulting in a debt of $5,000.

If the value of Sara’s ETH goes down and the debt to borrow increases, her ETH may be sold to cover the debt.

In such cases, the client’s taxable obligation on the sold ETH equals the debt that was wiped away on the loan.

Understanding the tax implications of liquidation and other borrowing activities can help individuals make informed decisions and avoid potential IRS tax penalties.

How Are Governance or Utility Tokens Taxed?

Governance tokens are cryptocurrency tokens that give users control and voting power over the associated blockchain.

They are a vital component of decentralized projects and allow users to vote on proposals that determine the project’s direction.

Many cases require users to report the value of these tokens at the time of receipt. They pay ordinary income taxes because they are taxable and distributed as a reward to users.

Earning Governance Tokens

On Compound, you receive COMP tokens as rewards in addition to the yield you earn on the ETH you deposited into the liquidity pool. These COMP tokens are the platform’s governance tokens.

These rewards are classified as ordinary income for tax purposes.

Is Wrapping Coins a Taxable Event?

In some cases, you may need to “wrap” your coins to participate in a specific decentralized exchange (DEX).

For instance, you might wrap your Bitcoin (BTC) to use it on the Ethereum network, creating Wrapped Bitcoin (wBTC).

Taking the wrapping method seriously is crucial regarding taxes and cryptocurrencies, as it is considered a taxable event. Wrapping a token typically generates a benefit for the holder that differs from the original asset.

For example, WETH can be used to bid on an item on Opensea, but ETH cannot. WBTC can cross-chain when BTC is only available via exchanges or BTC wallets.

Investors should be aware of the taxable nature of wrapping and stay updated with any changes in tax laws. By understanding these implications, individuals can meet their obligations and prevent any potential issues in the future.

Each wrapping scenario should be evaluated on a case-by-case basis.

Is Bridging Assets Considered a Taxable Event?

The tax implications of bridging assets in decentralized finance (DeFi) can be a gray area.

While some may consider it a taxable event to move from one contract address to another by changing chains, others may view it as a non-taxable self-transfer.

It’s important to remember that certain chains may require wrapping a token to move between them.

When wrapping a token and going cross-chain, it’s generally best to consider it a taxable event.

Taking a conservative approach, it’s likely that bridging assets would be considered taxable, given that they involve a transfer of assets from one chain to another.

However, some clients may take a more aggressive stance and view these transactions as non-taxable self-transfers.

To ensure compliance with crypto tax laws and regulations, it’s always a good idea to seek the advice of a cryptocurrency tax lawyer who can provide guidance on the tax implications of bridging assets in DeFi.

Staying informed about changes in the tax laws and regulations related to DeFi can also help you avoid potential issues in the future.

Is There DeFi Tax on Transferring Between Your Accounts?

You might have to pay gas fees for moving your crypto from one account to another. But these fees aren’t a part of your capital gain calculations (granted, both are your accounts).

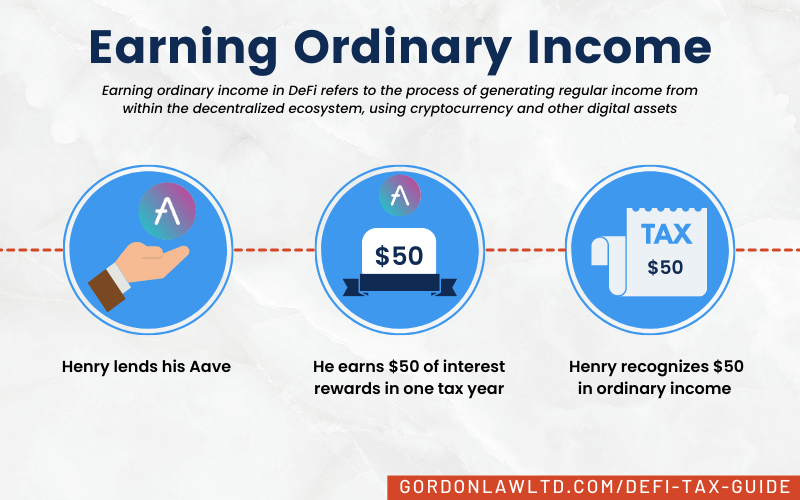

Lending, Liquidity Pools, and Earning Interest

Are you looking to earn interest on your cryptocurrency? In order to provide liquidity, you can deposit your tokens into a protocol like Uniswap.

By doing so, traders who use the liquidity pair will pay fees, a portion of which will be rewarded to you.

This entry into a liquidity pool will be considered a taxable event.

However, if you stake your tokens into a single-sided staking protocol, it will not be considered a taxable event.

Keep in mind that the interest earned from this process will be subject to ordinary income tax.

This is how you earn interest for providing liquidity in Decentralized Finance.

It’s important to note that the interest earned through this process is subject to ordinary income tax. However, depositing or withdrawing tokens into a DeFi platform is not taxable.

Protocol Tokens or Placeholder Tokens

For example, you are depositing 3 ETH into Compound to earn interest and receiving 3 cETH in exchange.

As the ETH moves around in the liquidity pool, the cETH becomes worth more ETH over time. When you exit the pool and return the cETH, you receive 5 ETH back.

So, what does this mean for taxes?

According to our stance, swapping ETH for ETH and cETH back to ETH is a taxable event that triggers a capital gain or loss.

Although some argue that these events are not taxable, this is an aggressive stance unlikely to be supported by the IRS during an audit.

The IRS has been increasing crypto audits in recent years.

How Does DeFi Approach Yield Farming Tax?

Staking or lending crypto tokens specifically for interest and rewards is yield farming. And as a yield farmer, you’ll have to measure your returns in terms of annual percentage yields (APY).

Yield farming, too, has yet to have specific tax rules. You’re yield farming income will be subject to income tax, and you’ll have to report capital gains tax if you make a gain through yield farming.

DeFi Taxes on Margin Trading Crypto

Crypto dealers use margin trading to use third-party funds in asset transactions.

The tax result? Your earning from margin trading transactions would be subject to the capital gains regime.

The tax rates for your margin trading crypto earning are:

- For long-term gains (assets held for longer than one year), the tax rate is 0%, 15%, or 20%, depending on the amount.

- For short-term gains (assets held for 1 year or less), the tax rate is the same as your ordinary income tax rate.

For more information on crypto capital gains rates, check out our Crypto Tax Guide!

What Are the Penalties for Not Reporting DeFi Taxes?

Failure to report DeFi taxes can result in significant penalties and legal consequences.

The specific penalties for not reporting DeFi taxes can vary depending on the circumstances, but some potential penalties include the following:

- Failure to File Penalty: 5% to 25% of the taxes you owe for each month your return is late.

- Failure to Pay Penalty: 0.5% to 25% of the taxes you owe for each month your payment is late.

- Accuracy-Related Penalty: Up to 20% of the unpaid tax, plus interest.

In some cases, failure to report DeFi taxes can result in criminal charges, such as tax fraud.

If convicted, you could face fines up to $100,000, prison time, or both.

Report your DeFi Taxes with Gordon Law Group

Dealing with taxes can be a nerve-wracking experience for many individuals and businesses. Still, when it comes to DeFi taxes, the situation can become even more complex.

The ever-evolving DeFi landscape, with its unique financial instruments and regulations, can make navigating DeFi taxes a challenge for even the most experienced tax professionals.

That’s where Gordon Law Group comes in. Our experienced team of crypto lawyers is here to help you navigate the complexities of DeFi tax filing.

Our attorneys are knowledgeable in all aspects of DeFi taxes. They will work with you to minimize your tax liability, optimize your tax strategies, and ensure that you get the best possible outcome from your DeFi investments.