Form 1099-DA: What We Know So Far

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

A question about digital assets, which has appeared on personal tax returns for several years, has been added to business tax returns as well.

When the IRS deadline is approaching and you can’t pay your tax bill, what should you do? Here are 5 tips from seasoned tax attorneys.

The IRS is targeting wealthy non-filers who haven’t filed tax returns between 2017 and 2021. Learn what you should do if you receive Notice CP59.

Need more time to file your tax return? It’s easy and free! Here’s how to extend your tax deadline step-by-step using IRS free file.

Navigating a tax audit can seem intimidating, but it doesn’t have to be a stressful ordeal. With the right knowledge and preparation, anyone can handle this process smoothly.

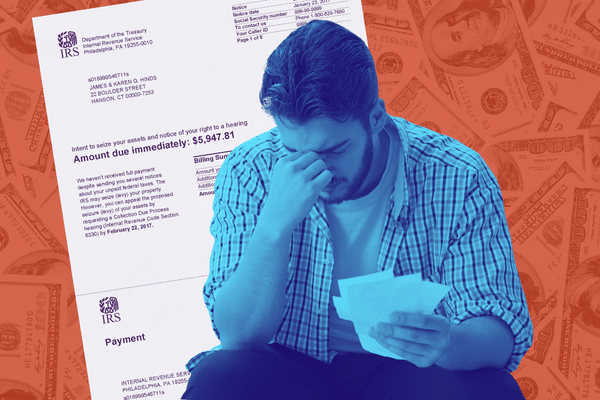

If you’re facing IRS wage garnishment, you may feel confused, angry, and overwhelmed. But you have options! Learn how to stop the IRS garnishing your wages.

Forming an LLC for cryptocurrency can enhance privacy and protect your assets. However, there are some misconceptions about the benefits of an LLC. Learn whether a crypto LLC could work for you!

The IRS has once again delayed the $600 threshold for Form 1099-K reporting. Our experienced tax attorneys explain what you need to know about this update and your filing requirements.

Are you struggling with Illinois Department of Revenue collections? Do you have overwhelming Illinois tax debt that you can’t afford to pay? You have options, and our Chicago tax law firm can help!

With 0% capital gains tax and 4% income tax, Puerto Rico can offer serious tax savings. Discover whether this is the right move for you.

Need help understanding your BOI reporting requirements? This guide from experienced business attorneys breaks down who needs to file and how.

Did you receive a CP2000 letter about cryptocurrency taxes? We can help!

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279